As a licensed and experienced mortgage agent, it’s my responsibility — and my passion — to match every client with the lender that offers the best combination of security, flexibility, and value.

Today, I’m proud to introduce an incredible opportunity through a name you already know and trust: TD Canada Trust. While TD is recognized across Canada as one of our top financial institutions, what many clients don’t realize is that TD’s broker channel provides exclusive mortgage solutions not available directly at their branches. These specialized options give you a significant advantage when securing your real estate financing.

What Makes TD Broker Channel Different?

Three Powerful Reasons to Choose TD Canada Trust’s Broker Channel

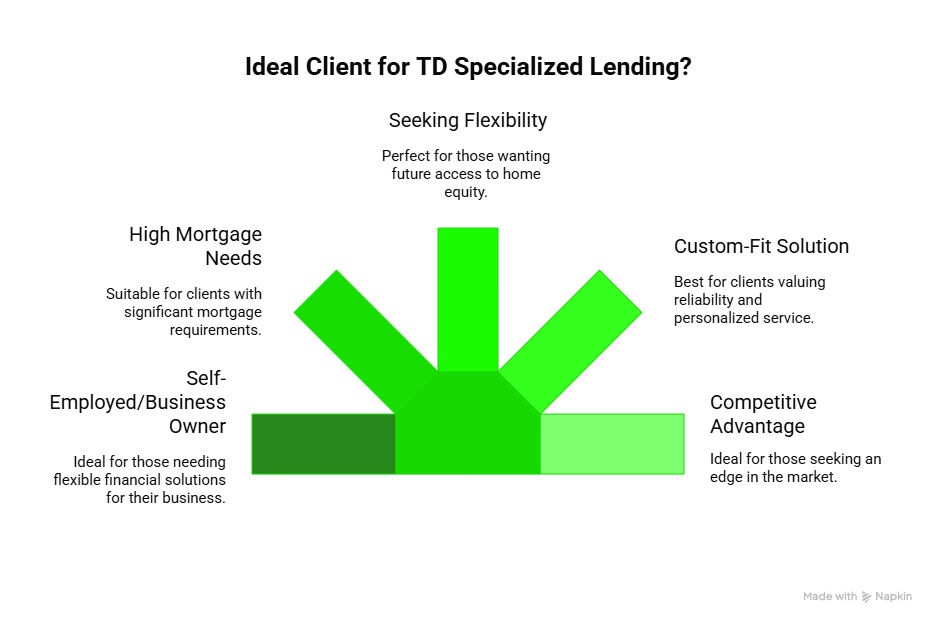

Ideal Client for TD Canada Trust’s Specialized Lending?

Why TD Canada Trust Stands Apart

Who is TD Canada Trust — and What Makes Their Broker Channel Different?

TD Canada Trust is one of Canada’s largest and most respected banks, known for its financial strength, customer service, and commitment to Canadian homeowners. But behind the familiar brand is a dedicated division designed specifically to work with licensed mortgage professionals like myself — the broker channel.

What is the Broker Channel?

The broker channel is an exclusive pathway where TD offers mortgage products and specialized solutions that are accessible only through accredited mortgage brokers. These products are separate from what you would find by walking into a TD branch.

When you work with me, I access this broker-exclusive system on your behalf, allowing you to benefit from:

- Specially tailored mortgage products,

- Competitive pricing models,

- Dedicated underwriting support,

- And mortgage structures built to offer greater flexibility.

Clients cannot access these offers by contacting TD directly — they are available exclusively through licensed brokers. As your mortgage agent, I act as your bridge, bringing you these powerful options without any additional cost to you.

In short: TD’s broker channel gives you all the strength of TD Canada Trust — combined with the customized service and flexibility of the broker world.

Three Powerful Reasons to Choose TD Canada Trust’s Broker Channel

When it comes to real estate financing, access to the right mortgage product at the right time can make all the difference. Through TD Canada Trust’s specialized broker channel, clients benefit from a suite of powerful advantages designed to offer greater flexibility, transparency, and opportunity. Whether it’s accessing live, competitive rates in real time, leveraging superior FlexLine and cashback options, or utilizing tailored programs for self-employed professionals and business owners, TD’s broker-exclusive offerings are built to meet the evolving needs of today’s borrowers — with the trusted strength of one of Canada’s most established banks behind them.

- Immediate Access to Live, Competitive Rates

- Superior FlexLine and Cashback Options

- Tailored Solutions for Business Owners and Professionals

Immediate Access to Live, Competitive Rates

TD’s specialized broker system allows real-time access to live rates through their TDMS portal. There’s no guesswork, no delays, and no hidden surprises — ensuring you can lock in opportunities immediately with confidence and clarity.

Superior FlexLine and Cashback Options

One of TD’s standout offerings is their FlexLine product, which merges a mortgage and line of credit into one powerful financial tool. Clients enjoy cashback incentives that are automatic and straightforward, without needing a chequing account. For larger mortgage amounts, FlexLine rates can be as low as Prime plus 0% — offering flexibility few lenders can match.

Tailored Solutions for Business Owners and Professionals

TD leads the way in flexible qualifying for self-employed clients and incorporated professionals. Their Net Income After Tax (NIAT) Program allows clients to qualify based on corporate income — not just personal income — unlocking far greater borrowing potential for entrepreneurs, medical professionals, and other business owners.

Who is the Ideal Client for TD Canada Trust’s Specialized Lending?

The ideal client for TD’s broker-exclusive offerings includes:

- Self-employed individuals and incorporated business owners with a strong T4 history.

- Borrowers with mortgage needs of $500,000 or more.

- Clients seeking flexibility, such as the ability to access a home equity line of credit in the future.

- Homebuyers or refinancers who value the reliability of a major bank but want a custom-fit solution.

- Anyone looking for a competitive advantage in today’s tight real estate and lending market.

By working through the broker channel, clients gain access to rates and options that aren’t advertised publicly, often enjoying greater savings and a more streamlined approval process.

Why TD Canada Trust Stands Apart

In today’s competitive mortgage environment, TD Canada Trust’s broker channel stands apart by offering:

- The strength and security of a nationally trusted bank,

- Broker-exclusive pricing structures and cashback programs,

- Flexible underwriting solutions that make financing more accessible and adaptable to each client’s situation.

Where other lenders often require trade-offs — sacrificing either rate, flexibility, or service — TD delivers all three, giving you a mortgage solution that’s truly built for your success.

My Final Thoughts

Choosing the right mortgage is about more than just picking the lowest rate — it’s about choosing a lending partner who offers strength, flexibility, and long-term support. Through TD Canada Trust’s broker channel, you are accessing the best of both worlds: the security of one of Canada’s largest banks, paired with the personalized solutions that only a professional mortgage agent can deliver.

As your trusted mortgage expert, I’m here to guide you every step of the way — ensuring you receive not only the best financing, but also the peace of mind that comes with working with Canada’s most respected financial institutions.

Let’s connect today and explore how TD’s exclusive broker programs can help you move into your next home, refinance smarter, or unlock your home’s potential with confidence.

Your financial success deserves a strong foundation — and together, we will build it.