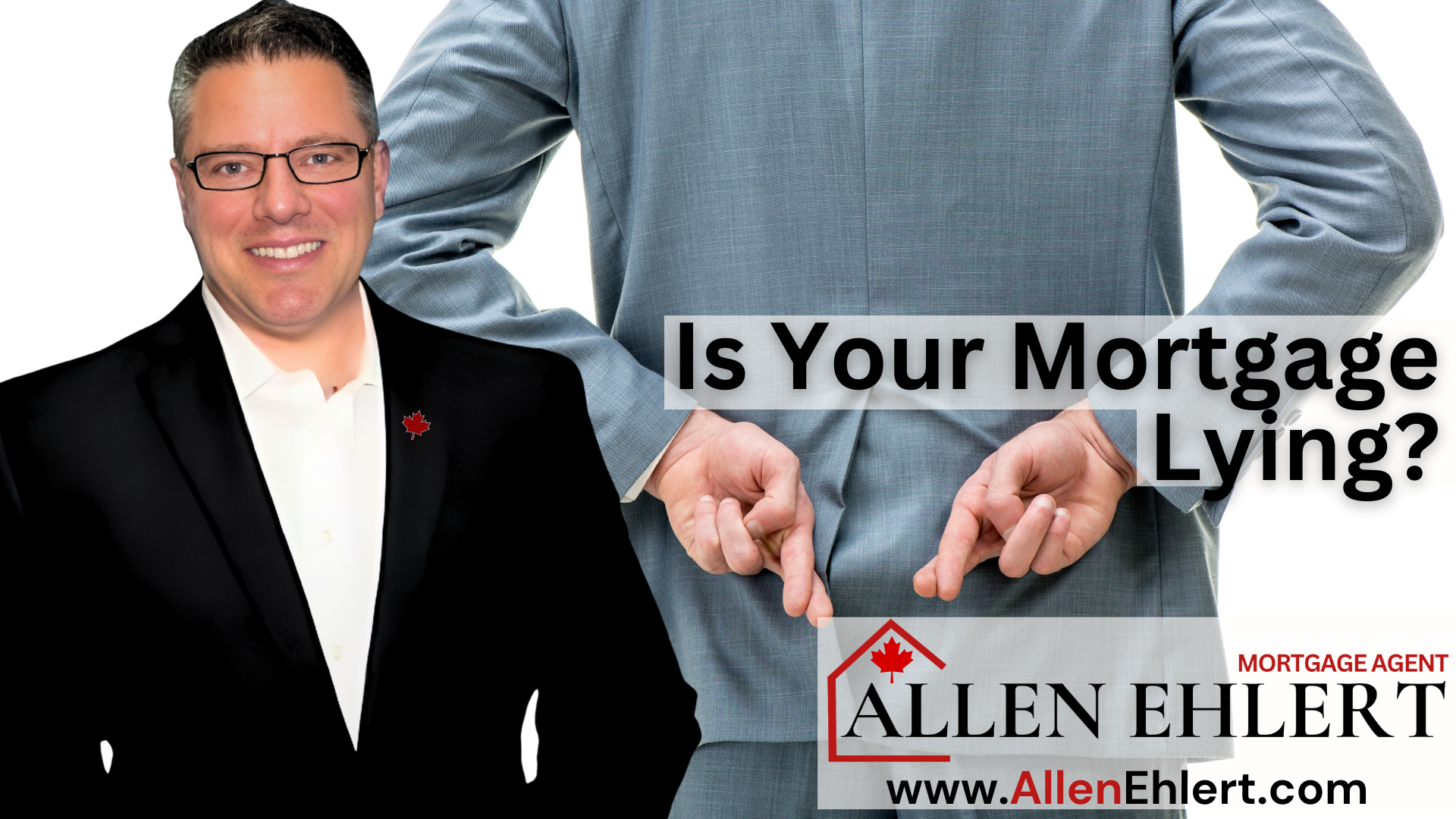

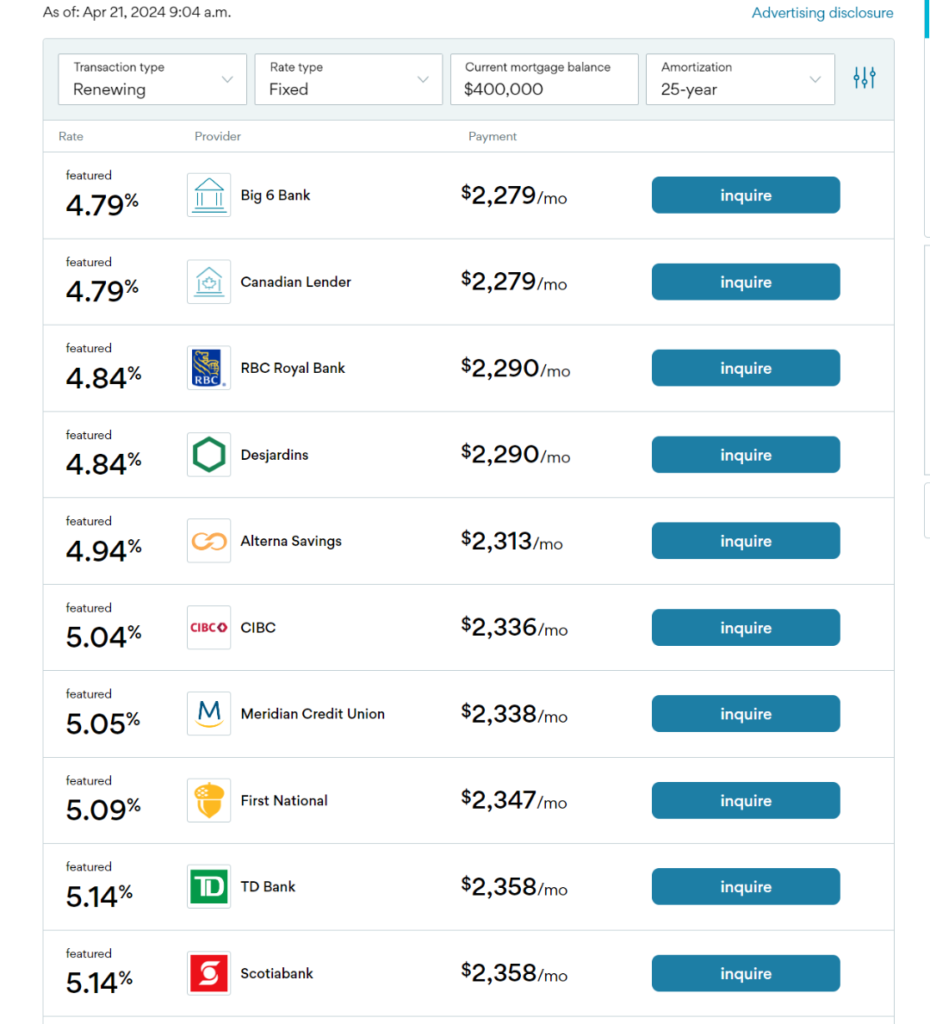

I got a response from social media where I quoted how much money I saved a client getting the exact same mortgage at the exact same bank but at a lower rate. The person sent me the following and said, “but these rates are lower”:

I replied, “Ah yes, the ol’ posted mortgage rate “Bait ‘n Switch”! Get’s ‘em every time!

OK, before I explain what I mean by clickbait “Bait ‘n Switch,” let me be direct and say none of the posted rates above (which I will explain in a moment) are the exact same mortgage offered by the exact same bank to the exact same clients that I spoke about in a previous article. Context is important. See that article here:

Now let me explain what I mean by clickbait “Bait ‘n Switch”.

First off, what is “Bait ‘n Switch”? “Bait and Switch” is a deceptive marketing practice where a business advertises a product at a low price to attract customers, but when customers try to purchase the advertised item, they find it unavailable and are instead pressured to buy a more expensive item. The initial offer (the “bait”) draws customers in, but then they are “switched” to a higher-priced or different product. This tactic is considered unethical and is illegal in many places because it misleads consumers.

What Is the Bait and What Is the Switch?

The bait is the advertised mortgage rate. It is bait because people who see these rates think they can go to any of these banks or financial institutions and get these rates, after all, that’s the mortgage rate being advertised. I should be able to walk into RBC Royal Bank and get a 4.84% mortgage rate no problem, right?

Not so fast….

Understanding Where Mortgage Rates Come From

First, look at the type of transaction the mortgage rate applies to, it’s for people renewing their mortgage. They get a different rate than people getting their first mortgage, or refinancing their mortgage, or porting/switching/transferring their mortgage, and so on.

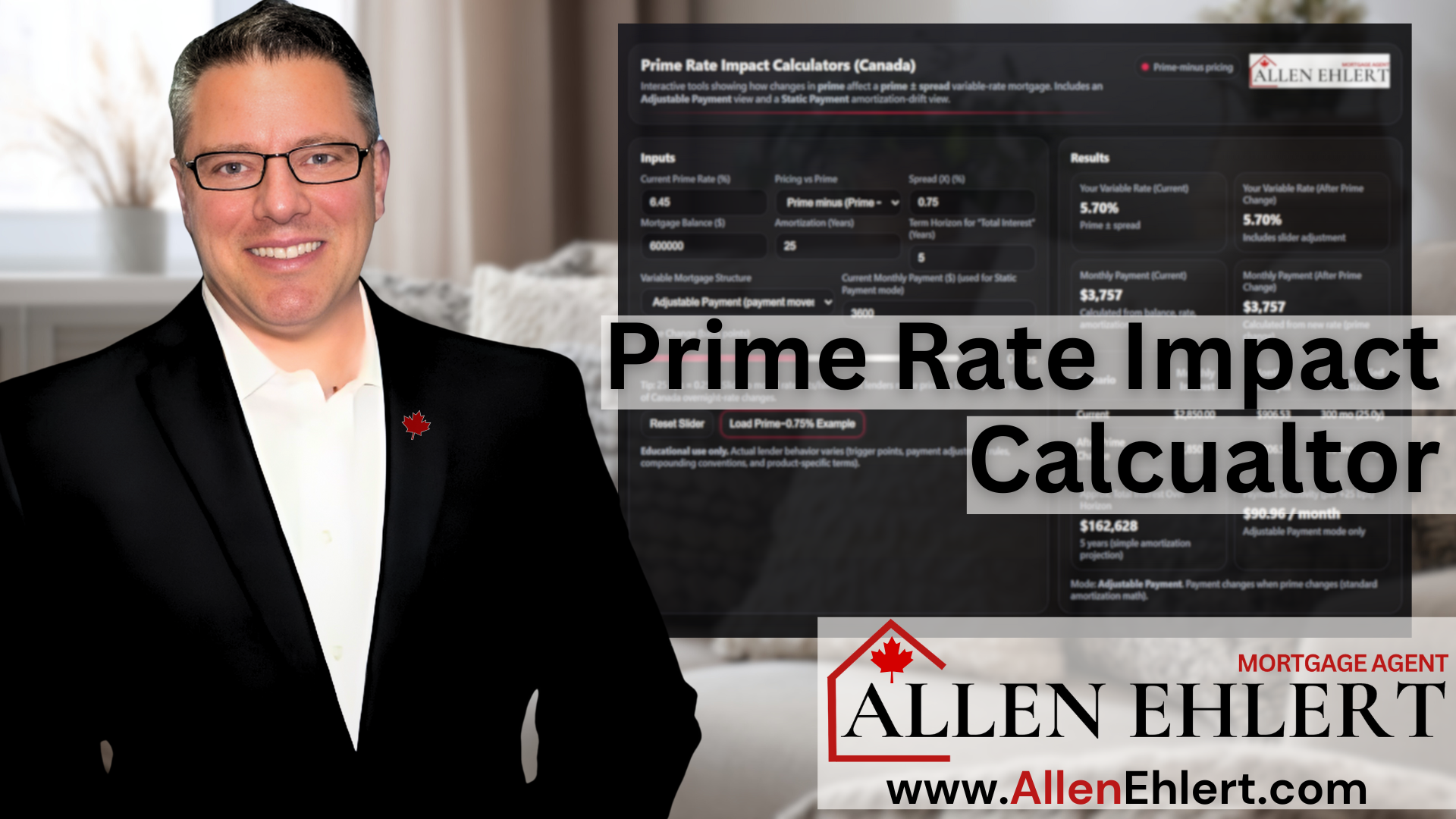

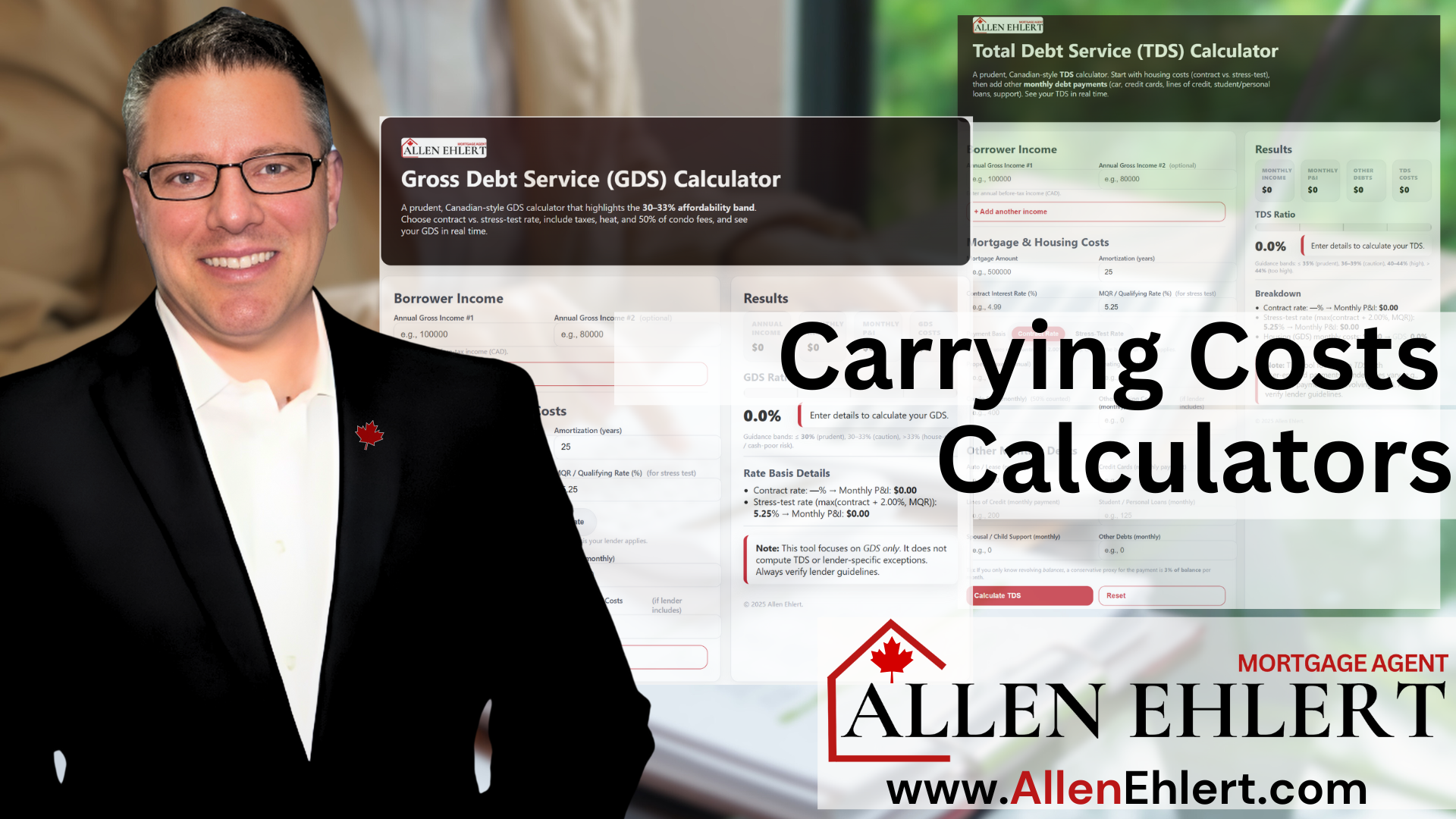

Next is the rate type; have you noticed it’s fixed, not variable? Variable rates have usually been cheaper if you look into the past, but not so presently (that’s a topic for another day). Look at the mortgage balance; you need to know that different balances have different rates applied as the size of the balance and the balance relative to the value of the property collateralizing the loan, known as LTV (Loan to Value) is a major measure of risk in mortgage models. Look at the amortization, it’s 25 year, not 10 or 20 or even 30. The longer the amortization, the larger the amount of risk a creditor is taking but this measure is tempered by the certainty and cash flow generated from the amortization. And what about the location of the house (can the home be sold quickly and how quickly exactly if the mortgage fails and goes into Power of Sale), the value of the property (what is the rate of change in the property’s value and has it increased or decreased and over what period), the years of employment (goes to income stability and ability to repair the loan) and type of employment of the applicant (permanent, temporary, contract), the industry of the employer (government or private sector), the occupation of the applicant (are you an actuary for the insurance company or do you work in sales), or their credit score, and so on… There can be 40 or more criteria that go into a lender’s mortgage model, resulting in the rate approved for any individual client.

When you see an advertisement for mortgage rates, you can be sure those advertised rates are the absolutely lowest rate offered to the absolutely lowest risk client with the longest, most stable employment history and the very highest income and credit score who needs a very small mortgage relative to the very high value of the very most marketable property. Is that you? Is that most people? That’s the bait to lure you in.

Now let’s look at the ‘switch’. Look out! Here comes the sales pitch… all you have to do is click the little blue inquire button on the right and GOTCHA! I can just hear the casting reel on that sales/fishing rod scream out as the customer takes the bait! All that’s left to do is reel ‘em in! Quick… get the gaffing hook!

“Oh, I’m sorry, you don’t qualify for this rate“…inferring you are not good enough—a sales technique based on psychology to break you down and make you feel bad about yourself so the ‘financial advisor’ or ‘mortgage specialist’ can switch you to a different higher rate or product, one that seems just a little more expensive, rationalized as perhaps even being cheaper, but is substantially more expensive for you over the long run, all to make you feel better about yourself, and how nice they are that they could be there to do this for you… or is that to you… Sometimes I can’t tell.

Quick question… If any of those lenders knew of a better product for you anywhere else, do you think they will put their sales quota at risk and tell you about it? Yeah, me neither! Could you imagine walking into a GM dealership showroom to talk to an auto advisor only to hear the advisor tell you, “Oh no, don’t buy our car, a Honda is a much better vehicle for you?” What do you think the advisor’s manager would say? Great Job! You truly helped that customer!!! Yeah, me neither!

Mortgages today are not yesterday’s mortgages. In the past, mortgages were fairly simple loans people got to buy a house, and that wasn’t so long ago. Today, mortgages are complex financial credit instruments with hundreds of different permutations. Remember the financial crisis of 2008 that almost brought down the global financial system? That happened because mortgage instruments and their derivatives (like Synthetic Collateralized Debt Obligations) were so incredibly complex, that even the experts couldn’t understand them.

Trying to communicate financial complexity to customers is hard, so institutions try to simplify things by reducing everything down to the rate, something that is easy for the customer to comprehend. The lowest rate must be the best (it isn’t). That is something the customer can understand, and the institution can sell.

The mortgage business is a hyper-competitive business. Many websites try to grab ‘views’ by advertising the lowest rates without ever taking on the responsibility of being completely transparent to those who visit the site about who can actually qualify for these rates. Rather, they have small legal ‘advertising disclosures’ on another page saying they can’t be held accountable.

So the real question isn’t what is the best advertised rate; the real question is what is the best rate for you keeping in mind there is so much more to a mortgage than simply the rate.

And sorry, that’s a more complicated discussion… but it would be a lie to tell you otherwise.