In today’s climate of economic uncertainty—uncertain interest rates, fluctuating home prices, and constant talk of a looming recession and market correction—buyers, sellers, and even industry professionals are understandably on edge. Many are asking, “What’s next for the market and how will the impact my home’s appraisal value?”

While consumers worry about where prices are heading, appraisers aren’t in the business of predicting the future. Their role is to answer a very specific question: What is this property worth today? In this article, we’ll explore whether appraisers consider future market conditions, why they’re not allowed to speculate, and how their approach brings stability to an otherwise unpredictable real estate landscape.

How Far Back in Time Does an Appraiser Consider Home Prices

Hierarchy of Comparable Strength

What is the Basis of an Appraisal

Professional Standards and Practice (CUSPAP)

Sample Appraisal Report Commentary

Who Does Appraisals

In Canada, professional real estate appraisals are carried out by certified appraisers who are members of recognized regulatory bodies, most notably the Appraisal Institute of Canada (AIC). These professionals hold designations such as CRA (Canadian Residential Appraiser) or AACI (Accredited Appraiser Canadian Institute), which represent rigorous academic training, practical experience, and adherence to the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP).

Governed by the AIC and provincial affiliates, appraisers are bound by strict ethical and professional standards designed to ensure impartiality, accuracy, and integrity in every valuation they complete. Whether working independently or with established firms, appraisers are trained to analyze market data, inspect properties, apply established methodologies, and deliver well-supported, defensible opinions of value. Their role is vital not only to lenders, but to buyers, sellers, lawyers, and financial institutions who rely on objective, third-party assessments of property value in an ever-changing real estate market.

How Far Back in Time Does an Appraiser Consider Home Prices

In Canada, professional residential appraisers typically look at comparable sales (comps) that occurred within the last 90 days when forming an opinion of market value for mortgage financing purposes. However, this time frame is not rigid—it depends on the market activity, location, and uniqueness of the property.

General Guidelines:

- Ideal Time Frame:

0–90 days prior to the effective date of the appraisal. This reflects the most current market conditions and is preferred by lenders and insurers like CMHC, Sagen, and Canada Guaranty. - Extended Time Frame (if necessary):

If there aren’t enough relevant comparables in the last 90 days (common in rural, slow, or highly unique markets), appraisers may extend their search to up to 6–12 months, especially if:- The property is in a seasonal area or a small market with low turnover.

- The property is custom or unique, where few similar homes are sold.

- Market conditions have been relatively stable over that time.

Hierarchy of Comparable Strength

Hierarchy of Comparable Strength:

- Most preferred: Recent sales (within 90 days), same neighborhood, similar size, age, condition, and style.

- Acceptable with explanation: Sales up to 6 months old, slightly further away, or with minor adjustments needed.

- Least preferred: Sales older than 6 months, from other neighborhoods, or requiring significant adjustments—these require strong justification in the report.

Appraiser’s Responsibility:

- Appraisers must comment on time adjustments if using older comps.

- They must explain why more recent comps are not available.

- The adjustments must be supported, logical, and in line with local market conditions.

Lender Requirements:

- Lenders, especially those relying on insured mortgages (CMHC, Sagen, Canada Guaranty), often prefer reports where at least two of the comps are within 90 days.

- Some lenders may flag or reject appraisals that rely heavily on outdated comparables without justification.

What is the Basis of an Appraisal

In Canada, professional appraisers must be objective, evidence-based, and present-focused, meaning appraisers do not predict the future or speculate on anticipated market changes in their estimate of market value.

Instead, they are required to form an opinion based on the most probable price a property would sell for on the effective date of the appraisal, assuming reasonable exposure in a competitive market. This is in line with the definition of market value under CUSPAP (Canadian Uniform Standards of Professional Appraisal Practice).

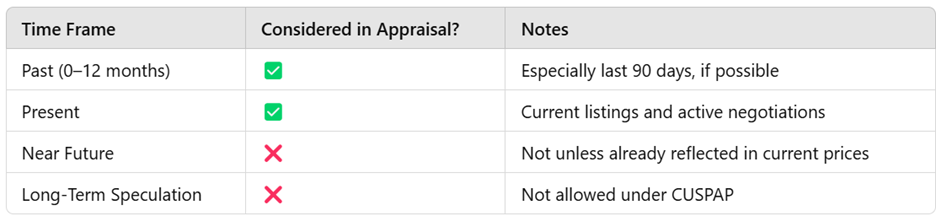

Here’s the breakdown:

What they can consider:

- Recent past and present: Appraisers analyze historical sales, active listings, expired listings, and current market trends leading up to the effective date.

- Demonstrable trends: If there’s evidence of recent price increases or decreases (e.g., 3 months of consistent price drops backed by MLS data), they can make time adjustments based on measurable data.

- Market momentum (if supported): In rapidly changing markets, they can comment on trends, but the valuation must still reflect the current market—not a future one.

What they cannot do:

- Appraisers cannot include future projections (e.g., expected interest rate cuts, new developments, government incentives, policy changes) unless those impacts are already reflected in the current market through verifiable data (e.g., pre-sale activity, builder pricing).

- They do not forecast future value or say, “This property will be worth X in 6 months” or “Prices will fall due to anticipated rate hikes.”

Professional Standards and Practice (CUSPAP)

The Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP) serve as the national framework that governs how professional appraisers in Canada conduct their work. Developed and maintained by the Appraisal Institute of Canada (AIC), CUSPAP is built on core principles of independence, objectivity, and due diligence. It outlines strict requirements for everything from property inspections and research methodology to market analysis and report writing.

At its heart, CUSPAP ensures that every appraisal is evidence-based, unbiased, and transparent, protecting both the public interest and the integrity of the profession. Whether assessing a modest home or a complex income property, appraisers must comply with CUSPAP’s ethical standards, maintain full disclosure of any conflicts of interest, and deliver conclusions that can be supported and defended with sound reasoning and documentation. These standards are not merely guidelines—they are enforceable, regularly updated, and reflect the evolving demands of a sophisticated real estate and lending environment.

Sample Appraisal Report Commentary

Sample Commentary in Appraisal Report:

“Due to the limited volume of recent sales activity within the subject property’s immediate market area, it was necessary to expand the search parameters to include comparable sales that occurred within the past 6 to 12 months. The subject is located in a rural/residential market characterized by low turnover and limited housing inventory. While efforts were made to locate more recent comparables, doing so would have required selecting properties from distinctly different neighbourhoods or applying excessive adjustments for key features.

The selected comparables represent the most appropriate available data in terms of location, size, design, and overall market appeal. Time adjustments have been applied where appropriate to reflect any observed market trends over the period. Local MLS and land registry data support the conclusion that market conditions have remained relatively stable during this time frame, thus supporting the reliability of these comparables in forming a credible estimate of value.”

Summary

In an era marked by economic volatility and speculation about where home prices and interest rates are headed, one question seems to surface repeatedly: Do appraisals take the future into account? I have attempted to explore the vital role of the professional appraiser in Canada and clarify a common misconception—appraisers don’t predict the future; they report on the present.

Governed by the rigorous framework of the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP), appraisers are held to the highest standards of independence, objectivity, and due diligence. Their role is to analyze current and recent market data—not assumptions or forecasts—and deliver credible, evidence-based opinions of value based on what a home would sell for today.

By breaking down who actually does appraisals in Canada, how far back they look when finding similar homes (called “comparables”), and how they decide which ones are most reliable, I hope I was able to calm some nerves around appraisals. I also wanted to clear up what appraisers are allowed to include in their reports—and what’s off-limits. I hope the sample explanation shows how they back up their choices when the data is thin. With so much uncertainty in today’s market, it’s easy to get caught up in guessing what’s coming next—but appraisers don’t do that. Their job is to focus on what a property is worth right now, and that’s what makes their role so important.