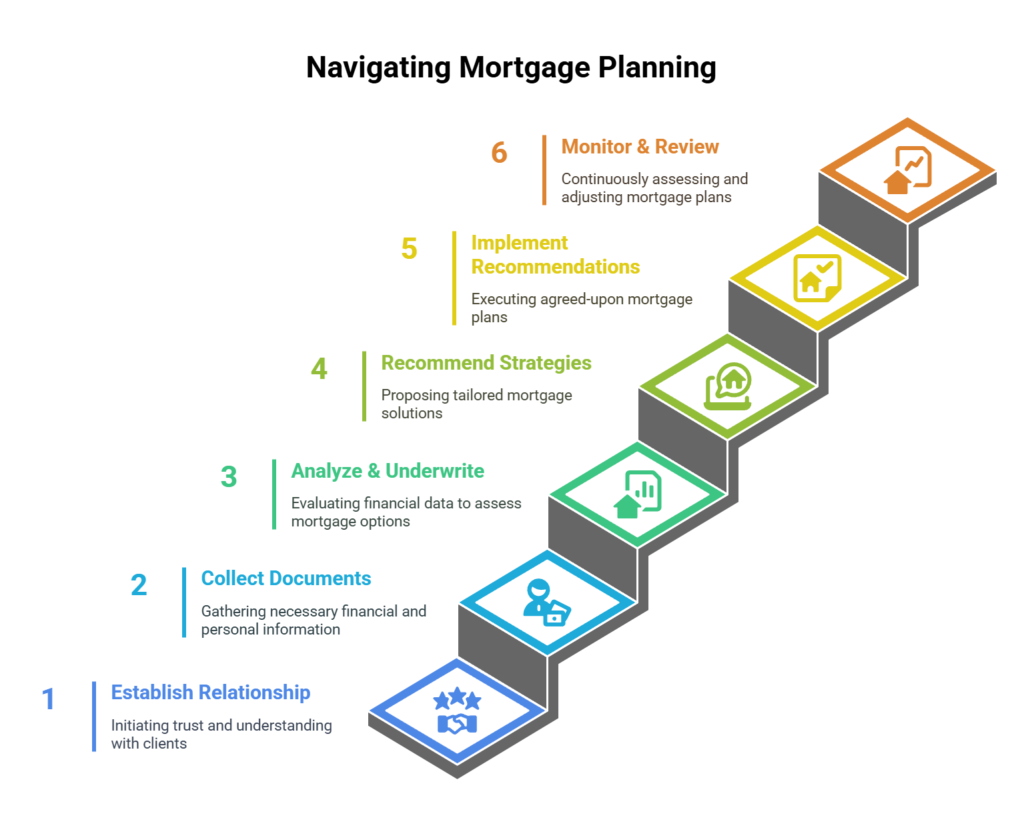

Mortgage financial planning is an integral part of a comprehensive financial strategy, ensuring that homeownership aligns with long-term wealth-building and financial security. By integrating mortgage decisions into six key phases of mortgage planning—I help borrowers optimize their mortgage structure to maximize financial benefits. My structured approach helps homeowners and real estate investors make informed choices about mortgage products, debt management, tax efficiency, and investment growth. Whether purchasing a first home, refinancing, or leveraging home equity for investment, my mortgage plan ensures that real estate financing contributes to broader financial success rather than becoming a burden.

Collecting Mortgage Documents and Data

Mortgage Analysis and Underwriting

Establishing Our Relationship

The foundation of mortgage financial planning begins with establishing financial goals, which requires a deep understanding of your unique situation, needs, and aspirations. My process starts with an in-depth conversation where I listen carefully to not only your homeownership objectives, financial concerns, and long-term wealth-building plans, but also things like your risk tolerance and what you really want from your life as well.

At a high level, I assess your income, debts, assets, and credit profile to identify potential challenges or opportunities in securing the right mortgage solution to help get us oriented and pointed in the right direction.

Just as importantly, I evaluate whether I am the best person for you by considering your financial needs given your circumstances. Sometimes a mortgage isn’t the solution, and a line of credit will suffice. Other times, I may say you should stay where you are for the moment or suggest a strategy to build yourself up so we can work together in the future. It’s all about doing what’s right for you, both now and in the future.

In all our dealings you can expect me to act with integrity, objectivity, confidentiality, professionalism and diligence.

Collecting Mortgage Documents and Data

After establishing our relationship, the next step is to gather the mortgage documents and information required for the preparation of a mortgage financial plan.

To build a mortgage strategy that truly aligns with your goals, I start by understanding both the big picture and the finer details of your financial situation. This process goes beyond just collecting documents—I take the time to listen to your aspirations, concerns, and priorities so that we can create a mortgage plan that supports your long-term financial success.

I gather both qualitative data—your homeownership goals, risk tolerance, and future plans—and quantitative data—your income, debts, assets, credit history, and existing financial commitments. This is a two-way process, where I ask key questions to uncover opportunities and challenges, and you gain clarity on how different mortgage options impact your financial future. It’s also about implicit data—understanding factors that may not be explicitly stated, such as career stability, lifestyle choices, and personal financial habits.

Throughout this process, I maintain strict confidentiality, ensuring that all your information is handled securely and professionally. By identifying and prioritizing your goals, we can structure a mortgage solution that not only fits your immediate needs but also lays a strong foundation for future financial growth.

Mortgage Analysis and Underwriting

Once we’ve gathered all the necessary information, I move into the mortgage analysis and underwriting process to assess how your financial profile aligns with lender requirements and mortgage options.

This step is about more than just checking boxes—I take a comprehensive approach, analyzing your income stability, debt levels, credit history, and overall financial health to determine your mortgage eligibility and the best strategies for approval. I run detailed calculations on your gross debt service (GDS) and total debt service (TDS) ratios, ensuring they fit within lender guidelines while also keeping your payments manageable within your broader financial plan. I also anticipate potential underwriting challenges, such as variable income, self-employment, or unique credit circumstances, and proactively address them to strengthen your application.

This process isn’t just about qualifying for a mortgage—it’s about making sure your financing is structured to support your financial goals, whether it’s securing the best rates, optimizing cash flow, or building long-term equity. Throughout, I keep you informed, explaining the rationale behind each step so that you feel confident and empowered in your mortgage decisions.

Recommending Strategies

With a clear understanding of your financial profile and goals, I focus on recommending mortgage strategies and selecting the best products to help you achieve them. This isn’t about a one-size-fits-all solution—it’s about crafting a tailored approach based on my deep knowledge of the mortgage market, lender policies, and the broader economy.

Whether your priority is lower monthly payments, faster mortgage payoff, investment growth, or maximizing tax efficiency, I present mortgage solutions that align with your needs. We discuss key strategies, such as fixed vs. variable rates, shorter vs. longer amortizations, prepayment options, and leveraging home equity.

I encourage open dialogue—you’ll have the opportunity to express any concerns, ask questions, and gain clarity on the options available. Everything must align with your risk tolerances. If something doesn’t quite fit or if your priorities shift, we modify and fine-tune the plan together. My goal is to provide you with a mortgage strategy that not only works for you today but also supports your long-term financial success, ensuring you feel confident in every step of the process.

Implementing Recommendations

Now that we’ve identified the best mortgage strategy for you, the next step is implementation—bringing the plan to life by submitting your application to the right lender. This isn’t just about sending paperwork; it’s about positioning your application for success.

If there are unique aspects to your financial situation—such as self-employment, irregular income, or a recent credit event—I go beyond the numbers and craft a compelling business case to show lenders why approving your mortgage makes sense. I advocate on your behalf, requesting exceptions where needed and ensuring your application is as strong as possible. Beyond securing financing, I also help you consider mortgage insurance options, protecting you and your family in case of unexpected events like job loss, illness, or death.

Additionally, I make sure you have a team of trusted professionals—including lawyers, accountants, appraisers, and realtors—so that every aspect of your mortgage process is handled smoothly.

My goal is to not just get you approved but to ensure you move forward with a well-structured mortgage that supports your long-term financial health.

Monitoring and Review

Your mortgage isn’t just a one-time transaction—it’s a key part of your long-term financial strategy, and I’m here to help you monitor and review it as your life and the market evolve.

Over time, your circumstances may change—you might switch jobs, grow your family, receive a financial windfall, or face unexpected challenges. That’s why I stay proactive, keeping an eye on opportunities that could lower your payments, improve your cash flow, or accelerate your mortgage payoff. If interest rates drop, I’ll reach out to explore whether refinancing, early renewal, or a rate adjustment could benefit you. I also remind you of prepayment privileges, helping you take advantage of options to reduce interest costs. If you’re planning to buy a new home before selling your current one, I can advise on bridge financing to ease the transition.

Whatever changes come your way, I’m here to ensure your mortgage continues to work for you, not against you, adapting to new opportunities and challenges so that you stay financially strong and confident.

Summary

Mortgage financial planning is more than just securing a loan—it’s about integrating homeownership into a comprehensive financial strategy that supports your long-term wealth-building and security.

My approach follows six key phases: establishing our relationship, collecting mortgage documents and data, mortgage analysis and underwriting, recommending strategies, implementing recommendations, and ongoing monitoring and review.

From the start, I take the time to understand your unique goals, financial circumstances, and risk tolerance to ensure that every mortgage decision aligns with your broader financial plan. I go beyond just gathering paperwork—I uncover opportunities, address challenges, and advocate on your behalf to position your mortgage for success. Whether you’re purchasing, refinancing, or leveraging home equity, I craft a personalized mortgage strategy based on my deep market knowledge and lender insights. I remain by your side even after closing, proactively identifying opportunities to optimize your mortgage, reduce costs, and adapt to changes in your life and the economy.

My goal is to provide not just financing, but a mortgage solution that evolves with you—one that strengthens your financial future every step of the way.