… How to Calculate Property Transfer Tax Like a Pro

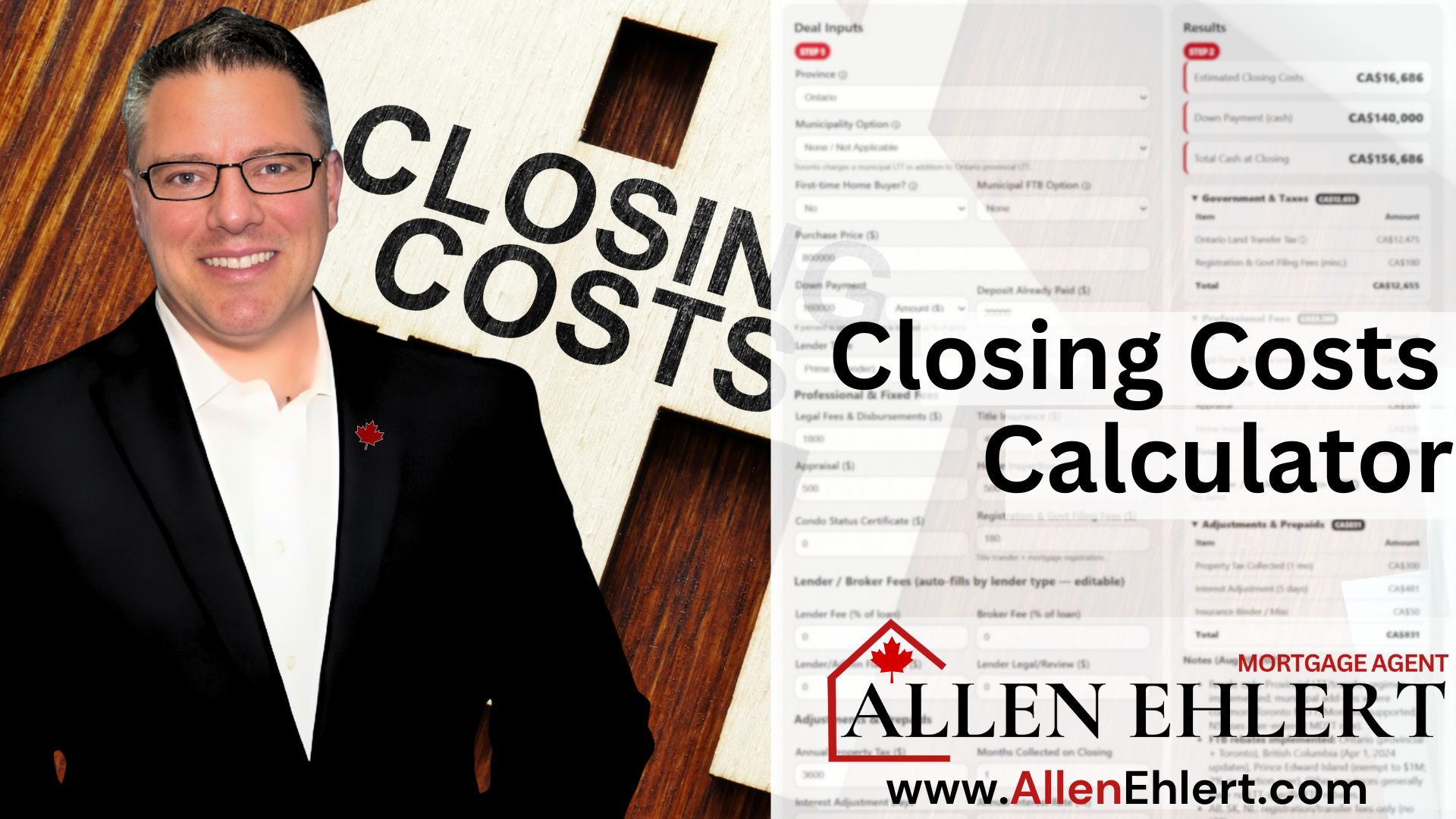

Buying a home in Canada is a thrilling adventure — whether it’s a downtown condo, a family home in the suburbs, or a cabin near the lake. But between deposits, inspections, and closing paperwork, there’s one cost that often catches buyers off guard: the Land Transfer Tax (LTT).

This tax exists in most provinces, but not all of them treat it the same way. Some don’t have one at all, while others double up with municipal versions that can add thousands to your total. That’s exactly why I created my Land Transfer Tax Calculator, available at www.AllenEhlert.com/land-transfer-tax-calculator. It’s designed to show you, in seconds, what you’ll owe — no matter where in Canada you’re buying.

Let’s break it all down together so you can understand how this tax works coast to coast, and how to use the calculator to your advantage.

Topics I’ll Cover

Why Some Provinces (and Cities) Charge Extra

When and Why You Have to Pay It

Rebates That Can Save You Thousands

Why It’s Not Technically a Closing Cost — But Still Due at Closing

How to Use the Canadian Land Transfer Tax Calculator

Real-Life Story: When Knowledge Saved a Deal

What Is Land Transfer Tax?

At its core, Land Transfer Tax is a fee you pay to the government when property ownership changes hands. It’s calculated as a percentage of the purchase price, with rates that typically increase in steps — the higher the property price, the higher the tax bracket you hit.

Every province handles this differently:

- Ontario, British Columbia, Manitoba, and Quebec have long-standing versions of LTT.

- Nova Scotia and Prince Edward Island call theirs “Deed Transfer Tax” or “Real Property Transfer Tax.”

- Alberta and Saskatchewan take a different approach — they charge smaller, flat registration or title fees instead of a percentage-based land transfer tax.

So, if you’re buying in Alberta, you’re in luck — no traditional LTT. But if you’re in Ontario or B.C., the tax can add up quickly, especially on higher-priced homes.

Why Some Provinces (and Cities) Charge Extra

In some regions, the province isn’t the only one taking a cut. Major cities — most notably Toronto — charge their own Municipal Land Transfer Tax (MLTT) on top of the provincial tax.

Toronto introduced this tax in 2008 to boost local revenue. Since then, homebuyers have effectively paid double the transfer tax: one to Ontario, and one to the City of Toronto. Other municipalities, like some in Nova Scotia, also impose local deed transfer fees that vary by community.

This means your location choice matters — crossing a municipal border could literally save you thousands.

When and Why You Have to Pay It

The land transfer tax (or its equivalent) is due at closing, the day your new home officially becomes yours. Your lawyer or notary will collect it and remit it to the province or municipality as part of the title registration process.

In plain language: until that tax is paid, the government won’t record you as the new owner. So, no tax payment, no title — and no keys.

It’s not optional or deferrable. You can’t roll it into your mortgage either; it has to be paid upfront in cash at closing.

Rebates That Can Save You Thousands

The good news? If you’re a first-time homebuyer, many provinces offer rebates or refunds that reduce — or even eliminate — your land transfer tax bill.

Here’s a quick snapshot:

- Ontario: Up to $4,000 provincial rebate; Toronto adds up to $4,475 more.

- British Columbia: Full exemption on qualifying homes under $500,000, partial on homes up to $525,000.

- Prince Edward Island: Full exemption if you’re a first-time buyer purchasing a principal residence.

- Nova Scotia & Manitoba: Certain municipal or provincial rebates may apply, depending on location and eligibility.

These programs can change, so always check the latest rules — or better yet, reach out to me and I’ll verify your eligibility before you budget.

Why It’s Not Technically a Closing Cost — But Still Due at Closing

Technically, land transfer tax isn’t a closing cost because it doesn’t pay for a service. It’s a government-imposed tax, separate from things like legal fees, appraisals, or title insurance.

However, because you must pay it at closing, it’s easy to confuse the two. Many buyers discover it at the eleventh hour, just as they’re signing their mortgage documents — and it can be a nasty shock if they didn’t plan for it.

Think of it as a stand-alone expense that rides shotgun with your closing costs. You can’t close without paying it, but it’s in a league of its own.

How to Use The Canadian Land Transfer Tax Calculator

My Land Transfer Tax Calculator takes the guesswork out of the equation and works for buyers anywhere in Canada.

Here’s how to use it:

- Visit www.AllenEhlert.com/land-transfer-tax-calculator.

- Enter your property’s purchase price.

- Select the province and city you’re buying in (this ensures the calculator applies the right tax structure).

- Indicate if you’re a first-time buyer to see potential rebates.

- Click “Calculate” and instantly view your breakdown — provincial, municipal, and total.

It’s a handy tool for both homebuyers and realtors who want to provide accurate cost estimates before making an offer.

Real-Life Story: When Knowledge Saved a Deal

Take Mark and Lisa, a couple moving from Calgary to Vancouver. They’d done all the math on their mortgage pre-approval and thought they had their down payment, closing costs, and legal fees covered. What they didn’t anticipate was British Columbia’s Property Transfer Tax, which came to nearly $20,000 on their $850,000 purchase.

They panicked — until their realtor sent them my calculator. By plugging in the numbers early, they realized Lisa qualified as a first-time buyer, reducing their total tax bill by almost half. That knowledge gave them the confidence to proceed — and close successfully, without draining their savings.

Allen’s Final Thoughts

Buying property in Canada comes with its fair share of surprises, but land transfer tax doesn’t have to be one of them. Whether you’re in Ontario, B.C., or Nova Scotia, understanding how much you’ll owe and when you’ll owe it is crucial for a smooth, stress-free closing.

My Land Transfer Tax Calculator was built to give you clarity — no fine print, no confusion, just simple, accurate numbers you can trust.

If you’re a realtor, share it with your clients to help them plan smarter. If you’re a homebuyer, use it before making an offer so you can avoid those last-minute “Wait, what?!” moments.

And as always, I’m here to help — not just with taxes and calculators, but with the entire mortgage process. Whether you’re navigating down payments, lender options, or strategies like the Smith Maneuver, I’ll help you create a financing plan that fits your goals and your life.

Reach out anytime — together, we’ll make your homeownership journey smoother, smarter, and a whole lot less stressful.