Who can give you the best mortgage? It’s the biggest financial commitment you’ll ever make. In Canada, there are literally hundreds of mortgage lenders out there offering thousands of different mortgages. Every day, more products are being introduced while others fade away. The market is a very dynamic place, and financial institutions are constantly innovating to meet the increasingly complex needs of Canadians.

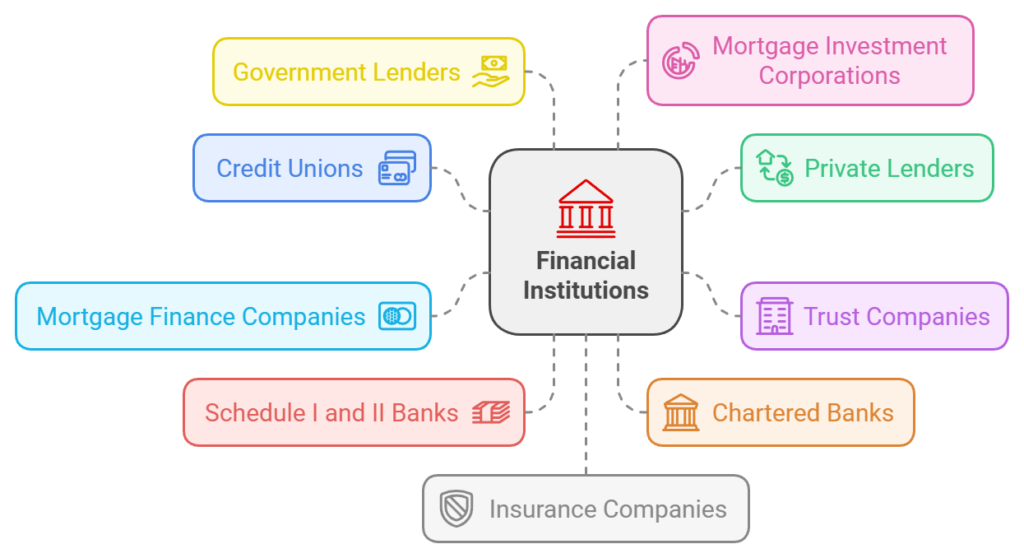

Let’s start by exposing the 10 different types of lenders providing mortgages in Canada today. Do you know who they are? Do you know how to access them? Some are Home Depots, some are local convenience stores, some are huge, and some are small. Their offerings are so different. Let’s break it down.

History of Mortgages in Canada

Did you know that when mortgage lending got started in Canada, Canadians didn’t go to banks to get their mortgage? Nope, it was the insurance companies that offered mortgages. Over time, as bank branch networks expanded, Canadians left insurance companies and went to their local bank branch for convenience. Today, most Canadians no longer get their mortgages primarily through their bank branch but through Mortgage Agents who are provincially licensed financial professionals who can provide unbiased mortgage advice and present their clients with products from the lender who is right for them and can compare and contrast the offerings of different financial institutions.

Different Types of Lenders

When it comes to mortgages in Canada, it’s not just about finding your best rate and the best product, it’s also about finding the right lender for your unique situation. But with so many options—chartered banks, monoline lenders, credit unions, and more—how do you know which one is best for you? Today, we’re breaking down the different types of mortgage lenders in Canada, how they compare, and which might be the best fit for you.

Credit Unions

Credit Unions are member-owned financial cooperatives that offer similar services to banks, including mortgages. They often have more personalized service and competitive rates for their members. Credit Unions are unique in that they operate on a not-for-profit basis, focusing on serving their members rather than generating profits for shareholders.

Examples include Meridian Credit Union, FirstOntario Credit Union, DUCA Credit Union, and many others.

Private Lenders

Private lenders provide mortgages typically funded by individual or group investors. They often cater to borrowers who may not qualify for traditional financing due to credit issues or unique property situations. Interest rates are higher than you would find from a prime or A lender, reflecting the increased risk such lenders take on. Private lending is short-term lending, usually for a year or less. It is also collateral lending, as private lenders generally look more closely at the borrower’s collateral, like the house or other property, than their credit score for example.

Trust Companies

Trust companies manage trusts, estates, and custodial arrangements but also provide mortgage lending services. They can offer a range of flexible mortgage products, often similar to those of banks. While they compete on rates for the lowest-risk customers, most trust companies offer mortgages as alternative lenders, focusing on clients who don’t qualify at the banks. Examples include Community Trust, Home Trust, and Effect Trust.

Mortgage Finance Companies

Mortgage Finance Companies provide mortgage solutions that often cater to niche markets or certain groups of clients that have unique needs and circumstances, such as self-employed individuals, contractors, business owners, newcomers to Canada, and even people with bruised credit. They may offer unique, alternative, or subprime mortgage options not available elsewhere. Examples include Eclipse, IC Savings, Fraction Lending, and Bridgewater Bank.

Schedule I and II Banks

Schedule I banks are Canadian owned full service financial institutions authorized under the Bank Act to accept deposits, provide loans, and offer other financial services. Examples include Tangerine, Equitable, Alterna, Motus, and Versa. These banks offer unique products not offered by Chartered banks, such as Reverse Mortgages, and alternative mortgage products.

Schedule II banks are subsidiaries of foreign banks that are authorized to operate in Canada, For example, Shinhan Bank of Canada is a subsidiary of Korea’s Shinhan bank. Such institutions tend to serve specific communities such as the Korean Canadian community and are sensitive to the unique characteristics, language needs, and cultural practices of their client base.

Chartered Banks

These are the large, federally regulated financial institutions that offer a wide range of financial services, including mortgages. They offer competitive but often not the very best rates due to their large overhead expenses, like bank branch networks and gleaming towers in major cities. Because chartered banks are lending out depositors’ money, they are heavily regulated and must focus on providing mortgages only to clients who meet fairly strict, cookie-cutter criteria. Mortgages sold by banks are sold by unlicensed, 100% commissioned salespeople who only sell their bank’s products and cannot provide unbiased mortgage advice. Chartered banks are interested in building cross-product financial relationships with their clients. They want clients to invest with them, deposit their money with them, get their insurance through them, get credit cards, etc. Examples include RBC, CIBC, BMO, TD and Scotia.

Government Lenders

Government-backed entities provide mortgage insurance and support programs to promote home ownership. While they do not directly lend money, they insure mortgages, reducing risk for lenders and making it easier for borrowers to qualify. Examples include CMHC, Genworth Canada, and Canada Guaranty.

Mortgage Investment Corporations

Mortgage Investment Corporations or MICs are pooled investment vehicles that provide private mortgage loans. They cater to borrowers needing non-traditional financing and offer returns to investors through mortgage interest payments. Some examples of MICs include: Timbercreek Financial, Atrium Mortgage Investment Corporation, Firm Mortgage Investment Corporation, and Trz Mortgage Investment Corporation

Insurance Companies

In the past, insurance companies were the primary place Canadians got their mortgages. Insurance companies offer innovative products most Canadians have never heard of before including an all-in-one bank account/mortgage/line of credit. Examples include Desjardins, Manulife, Industrial Alliance, and Sun Life Financial.

Monoline Lenders

Monoline lenders specialize exclusively in mortgages and do not offer other financial products, that’s what we call the monoline, they only have one line of product, mortgages. Monoline lenders often provide the most competitive rates because they don’t have the big overhead and heavy regulations of large financial institutions. Their mortgage products are only available through provincially licensed mortgage agents and their mortgages are principally funded through investor capital. Examples include First National, MCAP, RMG, and Marathon.

Summary

Who can give you the best mortgage? It’s the biggest financial commitment you’ll ever make. There are a lot of different mortgage lenders in Canada, and they offer thousands of different mortgage products. That’s why Canadians have turned to Mortgage Agents who have professional relationships with many lenders, can pick up the phone and talk to them anytime, represent your mortgage application, and go to bat for you.