In real estate transactions, an appraisal condition is a clause in the Agreement of Purchase and Sale that makes the buyer’s obligation to complete the purchase contingent upon the property’s appraised value meeting or exceeding the agreed-upon purchase price. This condition safeguards buyers by ensuring they are not overpaying relative to the property’s market value. It also provides assurance to lenders, who typically base mortgage amounts on the appraised value.

Key Aspects of the Appraisal Condition

Factors Considered in an Appraisal

Example: Appraisal Condition Clause

What is an Appraisal?

An appraisal is a professional evaluation of the market value of a property, typically conducted by a certified or licensed appraiser. Appraisals are used in real estate transactions to ensure that the property is accurately valued for buying, selling, or refinancing purposes. The appraisal reflects what the property is worth in the current market based on various factors.

Appraisals are conducted by certified appraisers who are independent and unbiased. In Canada, appraisers belong to professional organizations like the Appraisal Institute of Canada.

There are 2 types of appraisers: Residential and Commercial. Residential appraisals are done on single family homes, condos, or smaller multi-unit dwellings of 4 or less units. Commercial appraisals focus on income-generating properties like office buildings or apartment complexes of 5 or more units.

Key Aspects of the Appraisal Condition

- Purpose: To confirm that the property’s market value aligns with the purchase price, protecting both the buyer and the lender.

- Process: After the offer is accepted, a licensed appraiser evaluates the property. If the appraised value is at or above the purchase price, the condition is satisfied. If it’s below, the buyer can negotiate a price reduction, seek additional financing, or, if unable to resolve the shortfall, withdraw from the agreement without penalty.

- Relation to Financing Condition: While both conditions protect the buyer’s financial interests, they serve different purposes. A financing condition ensures the buyer can secure a mortgage, whereas an appraisal condition specifically addresses the property’s valuation. Including both conditions can provide comprehensive protection.

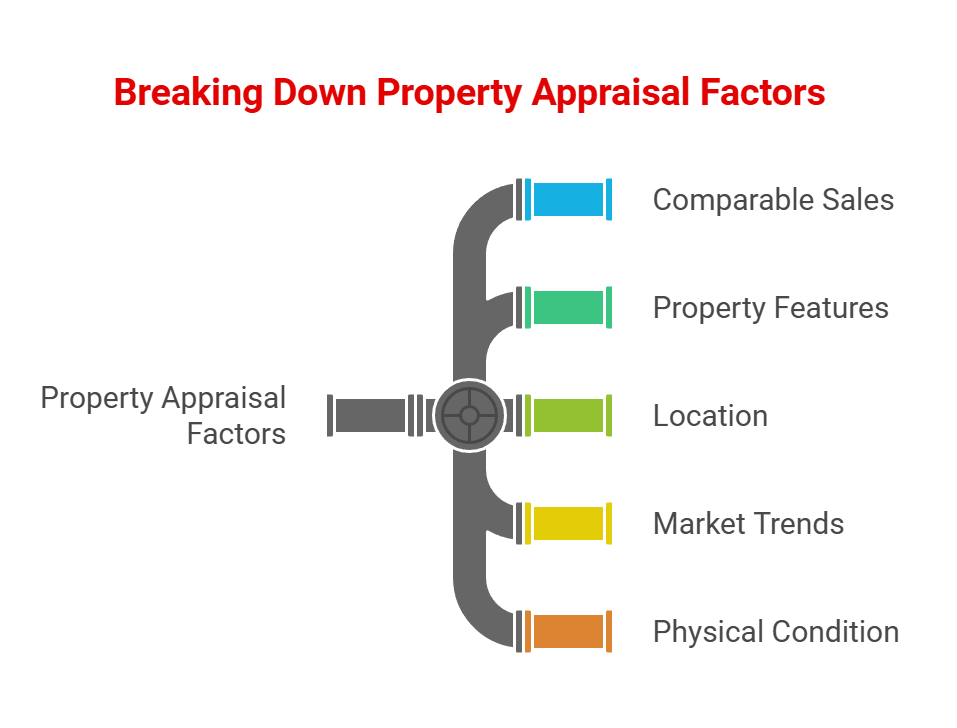

Factors Considered in an Appraisal

When conducting an appraisal, the appraiser considers the attributes of the property that contribute to the value of the property based on current market conditions:

- Comparable Sales: Prices of similar properties (comps) recently sold in the area.

- Property Features: Size, condition, number of bedrooms and bathrooms, lot size, and unique features.

- Location: Proximity to schools, amenities, transportation, and market desirability.

- Market Trends: Local real estate market conditions and demand.

- Physical Condition: Maintenance, upgrades, or repairs needed.

Incorporating an appraisal condition is particularly beneficial in fluctuating markets, where property values can be uncertain. It ensures that buyers do not commit to paying more than what the property is worth, thereby maintaining financial prudence.

Example: Appraisal Condition Clause

Here is an example of an appraisal condition clause that could be included in an Agreement of Purchase and Sale:

“This Agreement is conditional upon the Buyer obtaining, at the Buyer’s expense, a written appraisal of the property by a qualified appraiser, satisfactory to the Buyer and/or the Buyer’s lender, confirming that the appraised market value of the property is not less than the purchase price stated in this Agreement.

Unless the Buyer gives notice in writing to the Seller or the Seller’s representative not later than [date and time], confirming that this condition has been fulfilled, this Agreement shall become null and void, and all deposit monies shall be returned to the Buyer without deduction or interest.

This condition is included for the benefit of the Buyer and may be waived at the Buyer’s sole discretion by written notice to the Seller within the time period specified above.“

Key Elements

- Timing: The clause specifies a deadline for fulfilling the condition.

- Responsibility: The buyer is responsible for obtaining the appraisal and ensuring it meets the agreed terms.

- Outcome: If the appraised value is lower than the purchase price, the buyer can renegotiate or terminate the agreement.

- Flexibility: The buyer has the option to waive the condition if they choose to proceed regardless of the appraisal results.

This clause is critical for protecting both the buyer’s interests and their ability to secure financing based on the appraised value.

Appraisal vs. Home Inspection

A home appraisal and a home inspection serve different purposes in the home-buying process, with distinct focuses and outcomes. Here’s a summary of their key differences:

Home Appraisal

- Determines the market value of a property.

- Primarily conducted for the lender, paid for by the borrower, to ensure the property is worth the amount of the mortgage loan.

- Helps the lender assess their risk in providing financing.

Home Inspection:

- Evaluates the physical condition of the property.

- Conducted and paid for by the buyer to identify potential issues or defects (e.g., structural, mechanical, or safety concerns).

- Helps the buyer decide whether to proceed with the purchase or negotiate repairs or price adjustments.

The focus of an appraisal is the market value of the property based on factors such as location, size, condition, comparable sales in the area, and any unique features of the property. It is less detailed about the actual condition of systems or components of the home as that is not the expertise of the appraiser.

The focus of the home inspection is the condition of the property determined through a visual inspection of major systems and components (e.g., roof, plumbing, HVAC, electrical systems, and foundation). A home inspector identifies defects, safety issues, and potential future maintenance costs.

Also Read:

- How Much Does an Appraisal Cost in 2024?

- Appraisal Nightmare: Falling Home Prices

- Property Appraisal Process

- Appraisal Institute of Canada (AIC)

- Condition of Home Inspection

Comparison Table

| Feature | Home Appraisal | Home Inspection |

| Purpose | Determines property market value. | Assesses physical condition. |

| Conducted For | Primarily for the lender. | Primarily for the buyer. |

| Focus | Property value and comparables. | Systems, safety, and maintenance. |

| Mandatory? | Yes, for most mortgages. | No, but highly recommended. |

| Professional | Licensed appraiser. | Licensed home inspector. |

| Outcome | Appraisal report (value). | Inspection report (condition). |

| Cost | $300–$500. | $300–$600. |

Mortgage Strategy

The key advantage of the condition of appraisal is the mitigation of risk resulting from waiving condition of financing.

Condition of financing is usually waived within 7 business days of making an offer based on a lender’s mortgage commitment. The problem is that a mortgage commitment is not a commitment to give the borrower a mortgage. It is a commitment to provide a mortgage only if other conditions are met, such as the appraisal of the home being in line with the mortgage application. Unfortunately, sometimes an appraisal comes in lower than expected, and the mortgage isn’t funded by the lender. This puts the buyer in deep trouble as they have signed a contract to buy a home. The buyer will likely lose their deposit and be sued by the seller.

This risk can be mitigated if the buyer includes a condition of appraisal in the offer.

Read More:

- Real Estate Conditions

- Financing Condition

- Home Inspection Condition

- Sale of Current Property Condition

- Status Certificate Condition

- Appraisal Condition

Summary

An appraisal condition is a crucial safeguard for buyers and lenders alike, ensuring the property’s appraised market value meets or exceeds the agreed purchase price. This clause protects buyers from overpaying and reassures lenders that the property serves as sufficient collateral. Appraisals, conducted by certified professionals, evaluate market value based on factors like comparable sales, property features, location, and market trends. Including an appraisal condition is especially vital in fluctuating markets, as it provides flexibility to renegotiate or withdraw from the agreement if the appraisal falls short. While distinct from a financing condition, both serve to protect buyers’ financial interests, making appraisal conditions an essential component of prudent home-buying strategies.