…“Why Borrowing to Buy with Your RRSP Is Like Digging Two Holes and Calling It a Ladder”

You’ve probably seen the video clips on social media: someone cheerfully explaining how you can “stop using your own money” to buy a home. The idea sounds clever — borrow up to $50,000 from the bank, dump it into your RRSP, claim a juicy tax refund, then pull it back out 90 days later under the Home Buyers’ Plan (HBP) for your down payment. It’s marketed as a hack to get into the market faster, maybe even with “free money.”

But here’s the truth: this isn’t financial alchemy. It’s leverage stacked on leverage — and it can backfire in ways that leave you paying interest, losing borrowing power, and scrambling at tax time.

I’ve never heard a salesperson say, “now is not a great time to buy!”

Before I unpack that, here’s what I’ll cover:

The Home Buyers’ Plan Payback Problem

Summary: Why This Strategy is Not Usually Worth It

How Realtors and Clients Can Use This Info

The Double Borrowing Trap

Let’s start with the basics: you’re borrowing twice. Once from the bank for the RRSP loan, and once again for the mortgage. Oh, and you’ll have to payback your RRSP, so that actually 3 loans you owe on.

Even though you’ll technically withdraw the RRSP money “tax-free” under the HBP, the RRSP loan is still a live debt — one with interest, usually between 7% and 11%. You’ll often have to start paying it back immediately, long before your mortgage even begins.

Now, imagine this: you’ve got a $50,000 RRSP loan at 8% interest. That’s roughly a $4,300 monthly payment if you’re paying it off over a year. Add a new mortgage, car payments, credit cards — and suddenly, you’ve just loaded your financial backpack with an anvil.

How are you going to make those payments on top or your mortgage? The money tree in the backyard? From a behavioural finance standpoint, this strategy encourages leveraged optimism — the belief that using borrowed money to accelerate homeownership always pays off.

In reality, this amplifies exposure to:

- Market corrections

- Employment disruptions

- Interest rate increases

Any of these can turn an “investment shortcut” into a financial setback.

The Tax Refund Mirage

A big part of this strategy’s allure is the tax refund. You’re told that contributing $50,000 to your RRSP could save you $14,000 in taxes — which you can use to repay the RRSP loan. Sounds smart, right?

Here’s the problem: that refund isn’t free money. It’s a temporary tax deferral — money you’ll eventually pay tax on when you retire and withdraw the RRSP. And it’s not guaranteed to be as big as promised. If your income drops, or you already have other deductions, your refund could be thousands less than expected.

And the kicker? That refund arrives months later, while your RRSP loan payments start now.

The 90-Day Timing Gamble

CRA requires RRSP funds to stay put for at least 90 days before you can withdraw them under the Home Buyers’ Plan.

So, if you’re in a hot market and your closing date lands before that window, guess what? You can’t access the money. Deals have fallen apart over this rule. It’s a classic case of trying to sprint through a bureaucratic maze — timing and patience are everything.

The RRSP Room Reality Check

Your RRSP contribution room isn’t infinite. It’s based on your income and shown on your Notice of Assessment. If you try to contribute more than your limit, CRA charges you a 1% per month penalty on the excess. That “clever” $50,000 move could suddenly cost you hundreds or even thousands in fines.

The Home Buyers’ Plan Payback Problem

The Home Buyers’ Plan lets you withdraw up to $60,000, but you’ve got to pay it back into your RRSP over 15 years. Miss a year? That year’s payment gets added to your taxable income.

So, if you forget or can’t afford to make a repayment, you’ll get hit with extra taxes. Add that to your mortgage, property taxes, and RRSP loan repayment, and it’s easy to see why this strategy can snowball fast.

How It Wrecks Your TDS Ratio

This is where most people get blindsided. Lenders calculate your borrowing power using Total Debt Service (TDS) and Gross Debt Service (GDS) ratios.

TDS includes all debts — and yes, that shiny RRSP loan counts.

Even if you swear you’ll pay it off quickly, underwriters must include the full payment when calculating your mortgage qualification. For most buyers, that single RRSP loan payment kills their TDS ratio.

Let’s say you make $90,000 a year and have an RRSP loan payment of $4,300 a month. That alone can push your TDS ratio well past the 44% threshold most lenders and insurers allow.

And here’s the kicker: even though CRA is fine with the transaction, many lenders consider this a “borrowed down payment”, which violates their mortgage policies outright. So, you could go through all that trouble… and still get declined.

Summary: Why This Strategy Is Not Usually Worth It

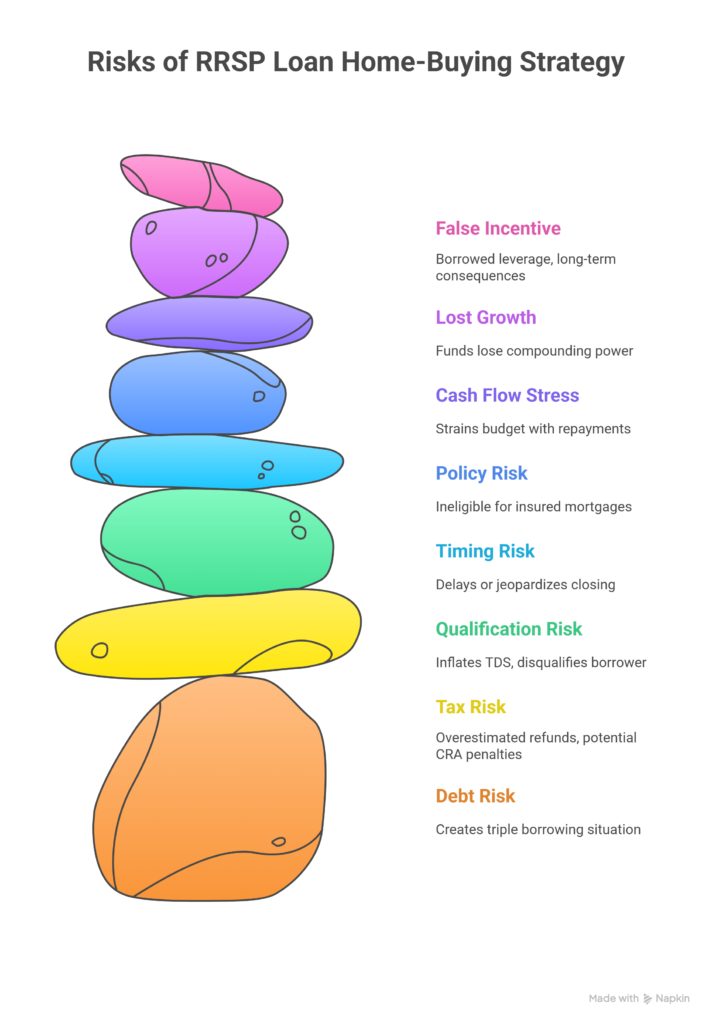

| Risk Type | Description |

| Debt Risk | Creates triple borrowing — RRSP loan, RRSP Payback, and mortgage. |

| Tax Risk | Overestimated refunds, potential CRA penalties, and taxable repayments. |

| Qualification Risk | RRSP loan payment inflates TDS and can disqualify borrower. |

| Timing Risk | 90-day rule can delay or jeopardize closing. |

| Policy Risk | Lenders often treat this as a borrowed down payment — ineligible for insured mortgages. |

| Cash Flow Stress | Short-term repayment of RRSP loan + mortgage startup costs strain budgets. |

| Lost Growth | RRSP funds lose compounding power when withdrawn. |

| False Incentive | Promoted as “free money,” but it’s borrowed leverage with long-term consequences. |

A Story from the Field

A young couple I once met, let’s call them Matt and Clara, tried this exact strategy. They borrowed $40,000 to contribute to their RRSPs, planning to use it under the HBP for their first home. They expected a $12,000 refund to cover the RRSP loan.

The refund came in at $8,000 — and their RRSP loan payment was $3,400 a month. When their mortgage broker submitted their application, the lender flagged the RRSP loan and declined the file due to high TDS.

They ended up delaying their purchase by a year, working hard to save an organic down payment instead. Ironically, by then, rates had stabilized and their finances were stronger. “We learned the hard way,” Clara told me. “Borrowing to save just doesn’t add up.”

How Realtors and Clients Can Use This Info

For Realtors:

When you sit down with a first-time buyer, ask where their down payment funds are coming from. If you hear “RRSP loan,” it’s time to hit pause and bring in a mortgage professional before the deal moves forward. A quick conversation can prevent a financing collapse weeks before closing.

For Clients:

If you’re eager to buy, focus on stability, not shortcuts. Contribute gradually to your RRSP, build savings in a TFSA, or explore co-ownership or gifted down payment options. You’ll qualify more cleanly, avoid double debt, and set yourself up for long-term financial comfort instead of stress.

Allen’s Final Thoughts

Here’s the bottom line — borrowing your down payment through an RRSP loan is like juggling fire while balancing on a ladder. Yes, it’s technically possible. But one misstep — a smaller refund, a missed payment, or a lender’s red flag — can burn your whole plan down.

Homeownership should start from a position of strength, not financial strain. As a mortgage agent, my job isn’t just to help you get approved — it’s to help you get approved safely.

So, before you sign for that RRSP loan, let’s sit down together. I’ll show you how to structure your down payment, strengthen your credit profile, and maximize your qualification the right way. We’ll build a mortgage plan that actually works — not one that just looks clever on TikTok.

Because the goal isn’t just to buy a home — it’s to keep it, comfortably.