Canada runs on credit.

A person’s three-digit credit score represents how likely they are to pay their bills. Your credit score impacts almost every aspect of your financial life. In this article, I break down what credit scores are, what a credit report is, and how they work and impact your financial affairs and your life:

The Credit Score: Your Financial Passport

Difference Between Credit Score and Credit Report

What is in Your Credit Report?

How Is a Credit Score Calculated?

The Credit Score: Your Financial Passport

Essentially, it is your financial life passport that enables you to do almost everything you need to do as an adult from accessing credit, getting a credit card, getting a mortgage, getting a reasonable car loan, and even getting a place to rent. Today, most landlords do a credit check on prospective tenants. Even some employers and insurance companies use your credit score for a variety of reasons. 42% of people have been denied a financial product in the past due to an insufficient credit score. Life becomes more expensive and difficult as your credit score falls.

Is the Credit Score Flawed?

Some argue that the credit scoring system today is flawed. Others disagree and say our system is the best in the world, and that criticism mostly comes from a lack of understanding around how credit scores are calculated and how they are applied. They argue that a world without credit scores would be much more expensive, and fraud would be out of control. In Canada, the Financial Consumer Agency of Canada is responsible for protecting the rights and interests of consumers of financial products and services. It supervises federally regulated financial entities, such as banks, and strengthens the financial literacy of Canadians.

What is a Credit Score?

A Credit Score is usually represented by a number between 300 and 850, which represents a person’s financial stability and creditworthiness. The higher the number, the better the person looks in terms of their ability to repay a loan promptly to a lender. Credit scores in the 500s or below are considered to be very bad. Credit scores in the 600s are considered subprime, or getting close to average. Credit scores in the 700s are considered average or typical and represent the typical creditworthiness of the average person. Credit scores of 800 and above are elite scores and enable such consumers to access any kind of credit at the very lowest cost or pay the very lowest available interest rate.

Difference Between Credit Score and Credit Report

Your credit score and your credit report are two different things.

A credit report is a statement about your present credit situation.

What is in a Credit Report?

A Credit Report is a complete picture of your financial history in detail. It contains:

Personal Information:

- Full name, including any aliases.

- Current and previous addresses.

- Social Security Number (or equivalent in countries outside the U.S.).

- Date of birth.

- Current and previous employers.

- Telephone number(s).

Credit Accounts:

- Types of credit accounts (e.g., credit cards, mortgages, car loans, student loans).

- The date accounts were opened.

- Credit limits and loan amounts.

- Account balances.

- Payment history, including late or missed payments.

- Status of accounts (open, closed, in collection, etc.).

Credit Inquiries:

- Record of who has requested the consumer’s credit report.

- Includes both hard inquiries (initiated by applying for credit) and soft inquiries (like a background check).

Public Records:

- Bankruptcies.

- Foreclosures.

- Lawsuits.

- Wage attachments.

- Liens.

- Judgments.

Credit Score (in some cases):

- A numerical summary of the consumer’s credit risk based on the information in the credit report.

- Different models exist for calculating credit scores (e.g., FICO, VantageScore).

Collection Accounts:

- Past due accounts that have been turned over to a collection agency.

Credit Utilization:

- The ratio of current revolving debt (e.g., credit card balances) to the total available revolving credit (credit limits).

Payment History:

- Record of on-time and missed payments.

- Includes details such as how late the payments were and how often late payments occurred.

Account Statuses:

- Information on the standing of each credit account (e.g., current, delinquent, paid off).

Remarks:

Any additional comments or notes, such as account closures by the creditor or disputes filed by the consumer.

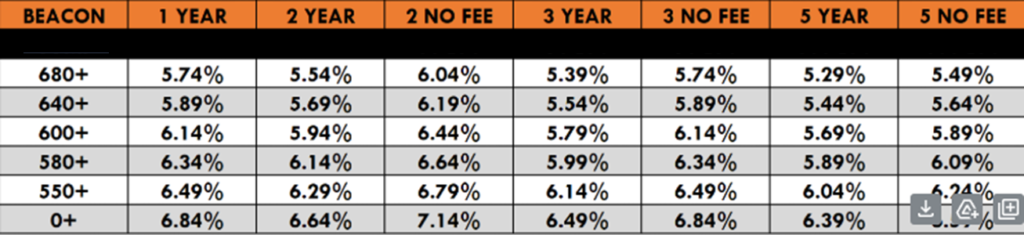

Your Credit Score and Your Mortgage Rate

Take a look at the table below from an alternative lender. The Beacon is a client’s credit score starting at the bottom with 0 (someone with no established credit) up to 680, which is the minimum score you would need to get a mortgage with a prime lender. Notice that as your credit score goes up, the rates go down. Credit score has a big impact on how much you pay for a mortgage.

How Is a Credit Score Calculated?

A Credit Score is based on a proprietary calculation performed by a credit rating agency. It is calculated from all the data collected from your credit report. Credit Scores are calculated by Fair Isaac Corporation or FICO. A Credit Score is calculated using 5 categories: payment history (35%), amount owed (30%), length of credit history (15%), amount of new credit (10%), and types of credit (10%). Looking at a person’s evolving credit score over a period of time provides a trend that enables lenders to predict future financial behaviour.

Your Credit Report is like the test you took in school. Your Credit Score is like the grade you got on your ‘Credit Score’.

Also Read:

- How Do Credit Scores Work

- How Do Credit Cards Work

- Credit Card Rewards. Who Pays?

- Credit Score and Your Mortgage

- Hard vs Soft Credit Pull

Credit Score: Social Importance

Today, Canadians are borrowing more than ever, with household debt at never-before-seen levels. Such a high level of consumer debt makes the Credit Score crucial to the operation of many businesses and aspects of our society. It allows lenders to make very precise decisions and have a very deep understanding of the likelihood of being paid back the money they lent. Further, the simple existence of the Credit Score can be praised for its ability to facilitate such low-interest loans and credit to be made to Canadians over many years, enabling Canadians to have a much better lifestyle than they otherwise could have had without the credit of the Credit Score. Without a trusted Credit Score, lenders are going to mitigate their risk by charging much higher interest rates, as they will not be able to identify the creditworthiness of any borrower.

Without the trusted Credit Score, the price of everything we buy in our economy would be much higher. Without the Credit Score, our economy would be much slower, employment would be much lower and the tax base which pays for our social services would be substantially less.

Credit Score Removes Discrimination

Before Credit Scores, lenders had to rely on subjective determinations, often making decisions based on biases and discrimination when making loan and credit decisions. What’s not on a Credit Report is gender, race, sexual orientation, politics, your level of education, or your socioeconomic background. The Credit Score removes most such forms of discrimination from the lending decision, providing for a more fair social and financial opportunity for all.