Real Estate Articles

Your Home, Your Life!

Canadian Land Transfer Tax Calculator

Land Transfer Tax Calculator: Buying a home in Canada is a thrilling adventure — whether it’s a downtown condo, a family home in the suburbs, or a cabin near the lake. But between deposits, inspections, and closing paperwork, there’s one cost that often catches buyers off guard: the Land Transfer Tax (LTT).

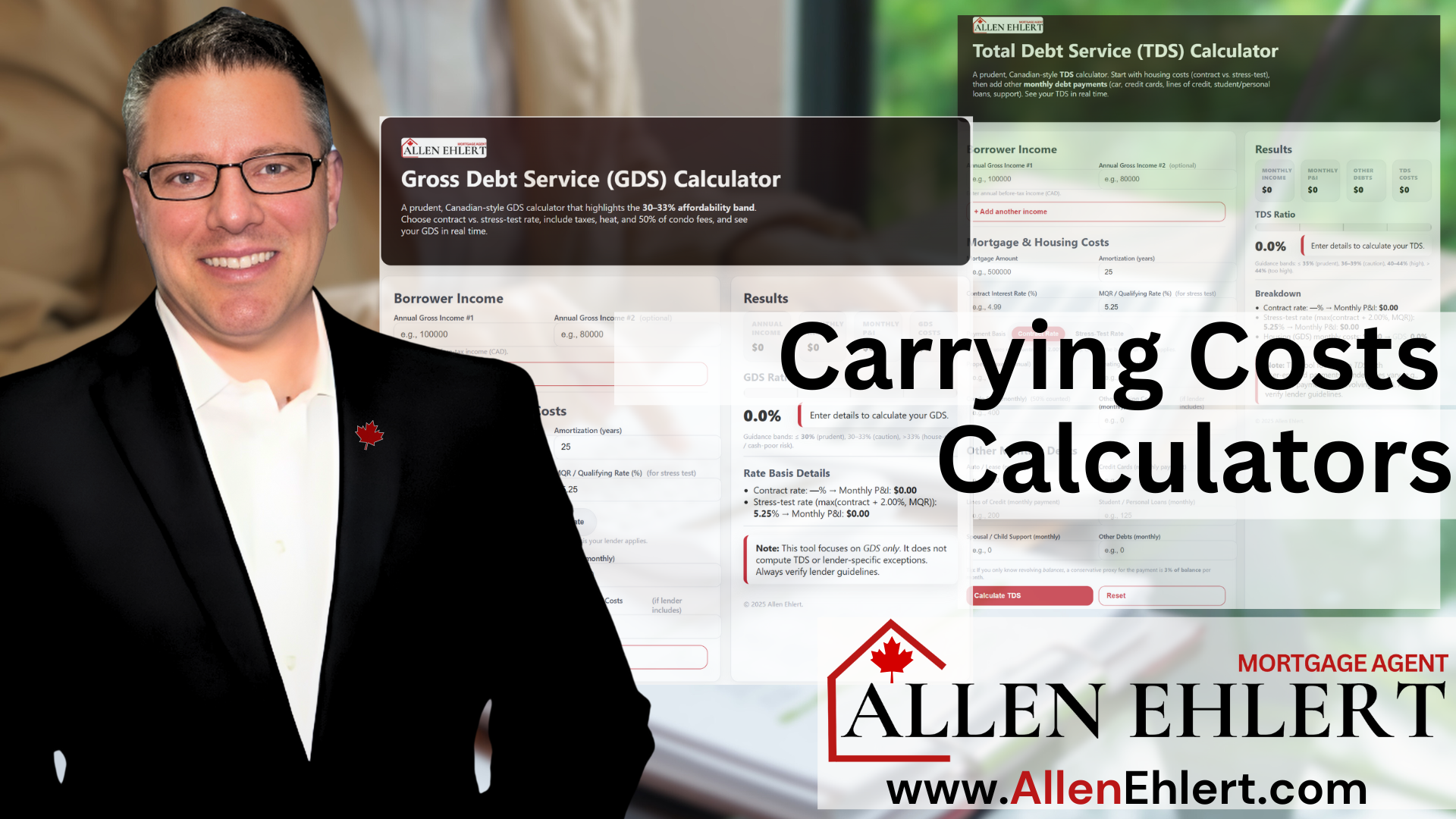

Home Carrying Cost Calculators

… Understanding Carrying Costs: The Unsung Hero of Smart Homebuying When most people think about buying a home, they focus on one number—the price tag. But seasoned buyers, realtors, and mortgage professionals know that the real story lies beneath the surface. The...

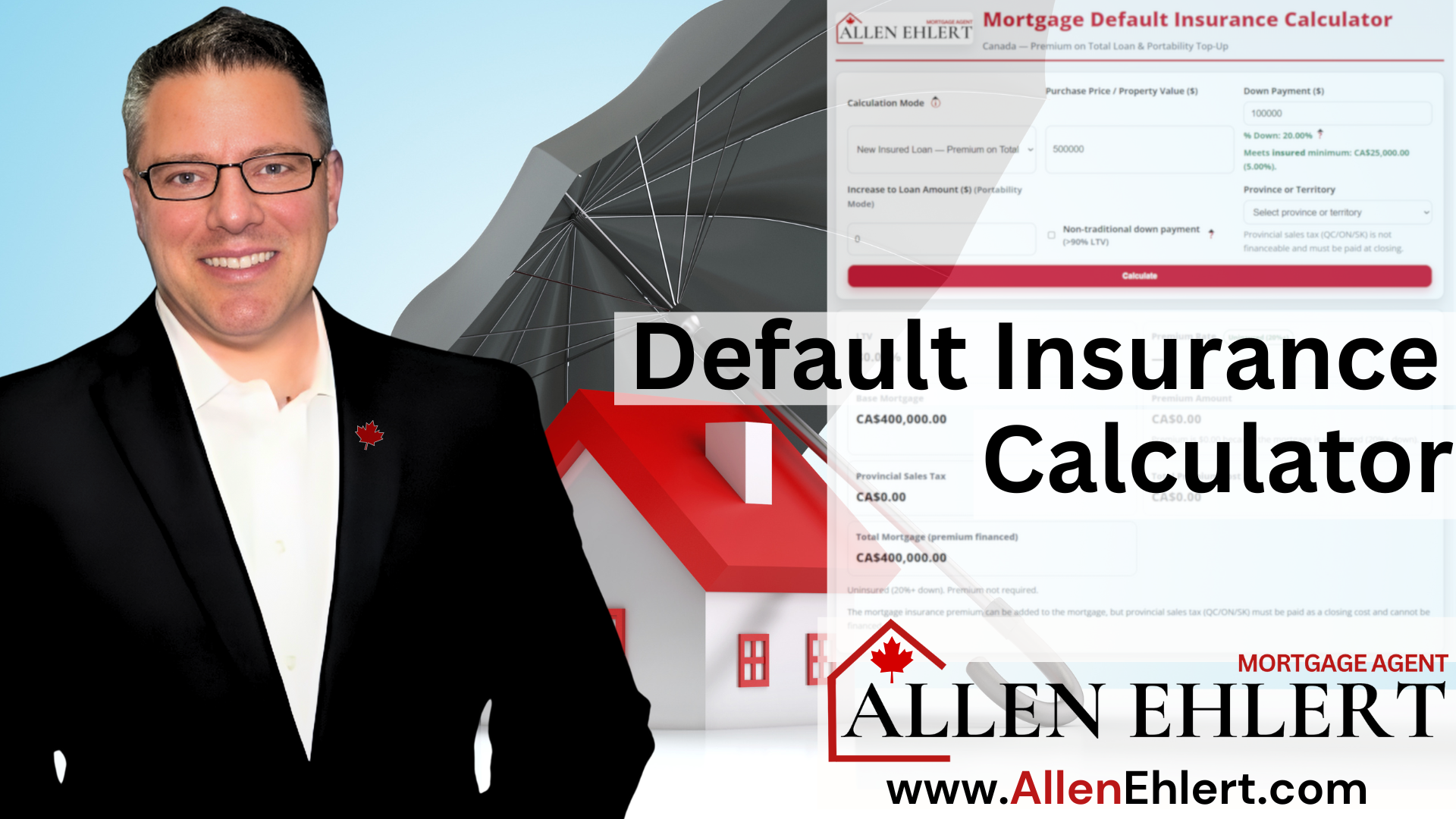

Mortgage Default Insurance Calculator

Mortgage Default Insurance Calculator: Buying a home in Canada can feel like stepping into a maze of numbers, acronyms, and fine print — but it doesn’t have to. Whether you’re a first-time buyer or a seasoned investor, understanding how default insurance works is key to knowing your real costs and options.

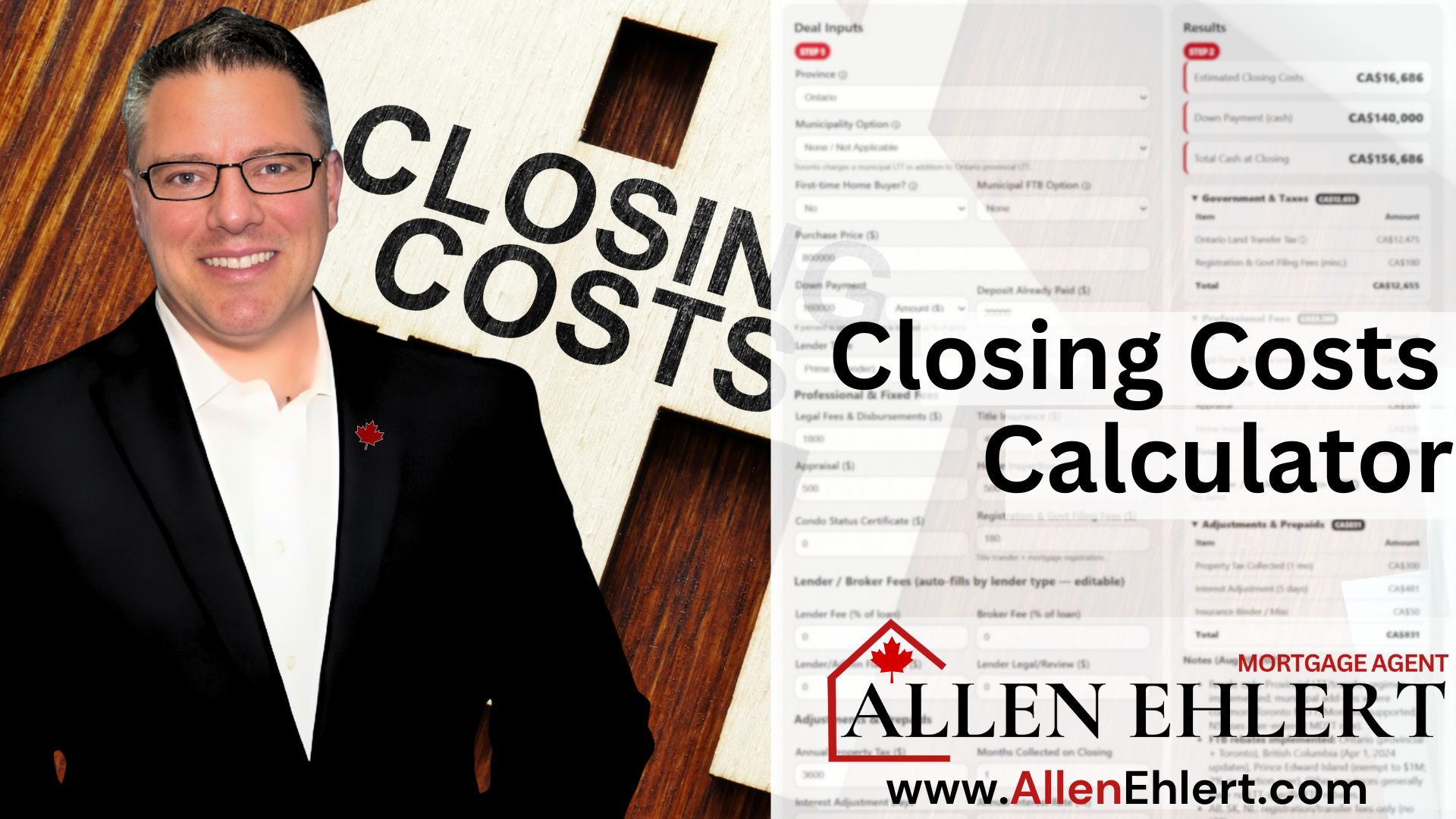

Canadian Closing Costs Calculator

Canadian Closing Costs Calculator: Buying a home is one of those life-changing moments that’s equal parts thrilling and nerve-wracking. Between scrolling listings, making offers, and imagining your first morning coffee in the new kitchen, it’s easy to overlook one key detail — closing costs. These aren’t the fun, HGTV-type parts of buying a home, but they’re essential.

Non Resident Tax Rebates (NRST, NRPDTT, BC PNP, etc.)

Foreign Buyer Tax Rebates (NRST, NRPDTT, BC PNP): When you first arrive in Canada, buying a home feels like crossing the finish line of a marathon—only to realize there’s another race waiting at the starting line: understanding the taxes, rebates, and programs that affect newcomers. One of the biggest hurdles foreign buyers face in Ontario is the Non-Resident Speculation Tax (NRST)—a hefty 25% charge on residential property purchases by non-residents.

Why My Pre-Approval Is Better

Pre Approval: When you’re getting ready to buy a home, that pre-approval letter feels like a badge of honour — proof that you’re serious, qualified, and ready to make your move. But here’s what most buyers (and most realtors) don’t realize: not all pre-approvals are created equal.

Stop Scrolling Realtor.ca

Get a Mortgage Agent first: Most people start their homebuying adventure exactly backwards. They hop onto Realtor.ca, fall in love with a gorgeous kitchen, picture their dog in the backyard, and then—usually with a little dread—they think, “Okay… how do we actually pay for this and what can we afford?”

Understanding Shelter Costs

Shelter Costs: If you’ve ever felt like lenders were speaking a different language when they talk about “shelter costs,” you’re not alone. Clients often look at me like I’m explaining astrophysics when I break down why lenders assign a shelter cost—even when a borrower is living in their parents’ basement and paying nothing more than a smile and a promise to take out the garbage.

10 Ways Urbanization Impacts Real Estate Prices

Urbanization trends significantly impact real estate prices due to a variety of interconnected factors: Increased Demand in Urban Areas Limited Supply in Dense Areas Changing Lifestyles and Preferences Infrastructure and Amenities Economic Opportunities Investment...

Transferring the Family Cottage

Transferring Cottages: Explore the essentials of transferring your family Cottage in Canada with ease. Understand tax implications, adjusted cost base, and more.

Call a Mortgage Agent FIRST!

Call a Mortgage Agent First: You’ve finally decided—it’s time to buy a home. Maybe you’ve been scrolling through Realtor.ca late at night, dreaming about that perfect place with the big backyard or a condo downtown near your favourite coffee shop. It’s exciting, no doubt. But before you call your best friend’s realtor or start booking showings, let’s hit pause.

Ultimate Canadian Closing Costs Calculator

The Ultimate Canadian Closing Costs Calculator. This tool doesn’t just spit out a random number—it walks through all the hidden (and not-so-hidden) expenses that come with buying a home in Ontario. It accounts for the type of buyer you are, the kind of mortgage you’re getting, and every little adjustment in between.

Canada’s Ultimate Home Purchase Price Calculator

Purchase Price Affordability Calculator: Buying a home is exciting—no doubt about it. But let’s be honest: it’s also one of the biggest financial decisions you’ll ever make. The million-dollar (well, sometimes literally) question is, “How much house can I actually afford?” That’s where my Purchase Price Affordability Calculator comes into play.

Marriage, Mortgage, Title, Death & Divorce

This article aims to shed light on the nuanced dynamics of property division in Ontario through multiple scenarios.

Handling Mortgage Obligations During Divorce

While divorce agreements or court orders may allocate property ownership and financial responsibility, these directives do not automatically release either party from joint liability under the mortgage contract. Lenders require specific actions to remove one party, making it essential to understand your options and obligations.

Finding A Commercial Mortgage in Canada

When it comes to commercial mortgages, most people think the only place to go is the bank. You walk in, shake a hand, sign some papers, and walk out with financing for that office building, warehouse, or rental property you’ve had your eye on. Sounds simple, right? Well… not quite.

Featured Publications

Articles

- Extended Amortizations and Hypothetical Calculations

Office of the Superintendent of Financial Institutions (OSFI) - Minimum Qualifying Rate for Uninsured Mortgages

Office of the Superintendent of Financial Institutions (OSFI) - Residential Mortgage Underwriting Practices and Procedures

Office of the Superintendent of Financial Institutions (OSFI) - Guideline on Existing Consumer Mortgage Loans in Exceptional Circumstances Financial Consumer Agency of Canada

Book: “The Program”

- Part 1 – Building Your Down Payment

- Part 2 – Mortgage Payoff Strategies

- Part 3 – Building Wealth Through Real Estate