Personal Finance

Securing Your Today and Tomorrow

The 10 Principles of APR

10 Principles of APR: But APR — the Annual Percentage Rate — is where the real truth lives, not in the advertised rate—which is NOT what you pay. APR exists to answer a more important question: what does this mortgage actually cost once everything required is accounted for?

Need a Mortgage? Start Here.

Need a Mortgage? Start Here: Buying a home—especially your first—can feel like stepping into a world where everyone else seems to have the rulebook but you. Rates, lenders, documents, jargon… it’s enough to make anyone feel like they’re drinking from a firehose. But when you follow the right steps in the right order, everything becomes clearer, calmer, and surprisingly empowering.

Protect Your Mortgage

Mortgage Protection Insurance: Buying a home, especially your first home is one of those big, life-defining moments. You and your partner have been budgeting, working with your mortgage agent, hunting down listings, talking to realtors, and imagining what that first night in a place that’s finally yours will feel like. But beneath all the excitement, there’s a quieter, more grown-up question that every couple needs to ask—“If something unexpected happens, can we not lose this home we worked so hard for?”

Understanding Contributory Income

Contributory Income: Every once in a while, a mortgage file comes along that makes you smile—not because it’s easy, but because you know exactly what lever to pull to make the deal work. Contributory income is one of those levers. It’s the quiet, seldom-talked-about income source that can turn a “maybe” into a confident “yes,” especially when buyers are stretched, ratios are tight, or affordability feels like a moving target. And if you’re a realtor guiding clients or a borrower trying to qualify, understanding how contributory income works is like unlocking a hidden chapter in the rulebook.

Understanding Shelter Costs

Shelter Costs: If you’ve ever felt like lenders were speaking a different language when they talk about “shelter costs,” you’re not alone. Clients often look at me like I’m explaining astrophysics when I break down why lenders assign a shelter cost—even when a borrower is living in their parents’ basement and paying nothing more than a smile and a promise to take out the garbage.

Smallest Mortgage You Can Get

Smallest Mortgage: Ever wonder how small a mortgage can actually be? Maybe you’ve nearly paid off your home and want to pull out a little equity for renovations, or you’re buying a modest rural property that doesn’t cost much. You might be surprised to learn that lenders in Canada do have minimum mortgage amounts—and they vary depending on the lender, the property, and even the province.

Transferring the Family Cottage

Transferring Cottages: Explore the essentials of transferring your family Cottage in Canada with ease. Understand tax implications, adjusted cost base, and more.

Call a Mortgage Agent FIRST!

Call a Mortgage Agent First: You’ve finally decided—it’s time to buy a home. Maybe you’ve been scrolling through Realtor.ca late at night, dreaming about that perfect place with the big backyard or a condo downtown near your favourite coffee shop. It’s exciting, no doubt. But before you call your best friend’s realtor or start booking showings, let’s hit pause.

10 Benefits of Choosing Fixed

Fixed Mortgages: Let’s face it—choosing a mortgage can feel like standing at a financial crossroads with a blindfold on. Do you gamble on a variable rate, hoping the market stays friendly, or do you lock into a fixed rate and sleep peacefully at night knowing exactly what your payment will be?

Time to Lock It In

Fixed Mortgage vs Variable Mortgage: If you’ve been sitting on the fence wondering whether to go fixed or variable with your next mortgage, you’re not alone. Every client, from first-time buyers to seasoned investors, faces that same moment of decision—do you take the guaranteed calm of a fixed rate, or do you play the market with a variable? The answer isn’t the same for everyone, but timing plays a huge role. And right now, as we reach the tail end of a rate-cutting cycle, the stars may be aligning for fixed-rate mortgages.

The History of Credit Cards

The History of Credit Cards: From Retail Tabs to Digital Wallets Credit is not new. Long before banks, apps, and plastic cards, merchants extended credit to trusted customers based on personal relationships. But the story of how that informal trust evolved into the...

Why Many Banks Provide Bad Service

Average Handling Time, Bad Bank Service, When was the last time you called your bank’s customer service line? If you’re like most Canadians, it wasn’t exactly a warm, fuzzy experience. You were probably shuffled around, put on hold, and when you finally spoke to a representative, they couldn’t wait to get you off the phone. Sound familiar? It’s not that the people answering don’t care—it’s that the system they work under is built to prioritize the bank’s bottom line, not your financial well-being.

Consumer-Directed Finance Is Almost Here

Consumer Directed Finance: Let’s be real—getting a mortgage in Canada can sometimes feel like dragging a sack of bricks uphill. Between pay stubs, NOAs, bank statements, and all the back-and-forth emails, it’s no wonder many clients feel stressed before the real house hunt even begins. But what if I told you there’s a new way coming that could cut through the red tape, give you more control, and make the whole process smoother?

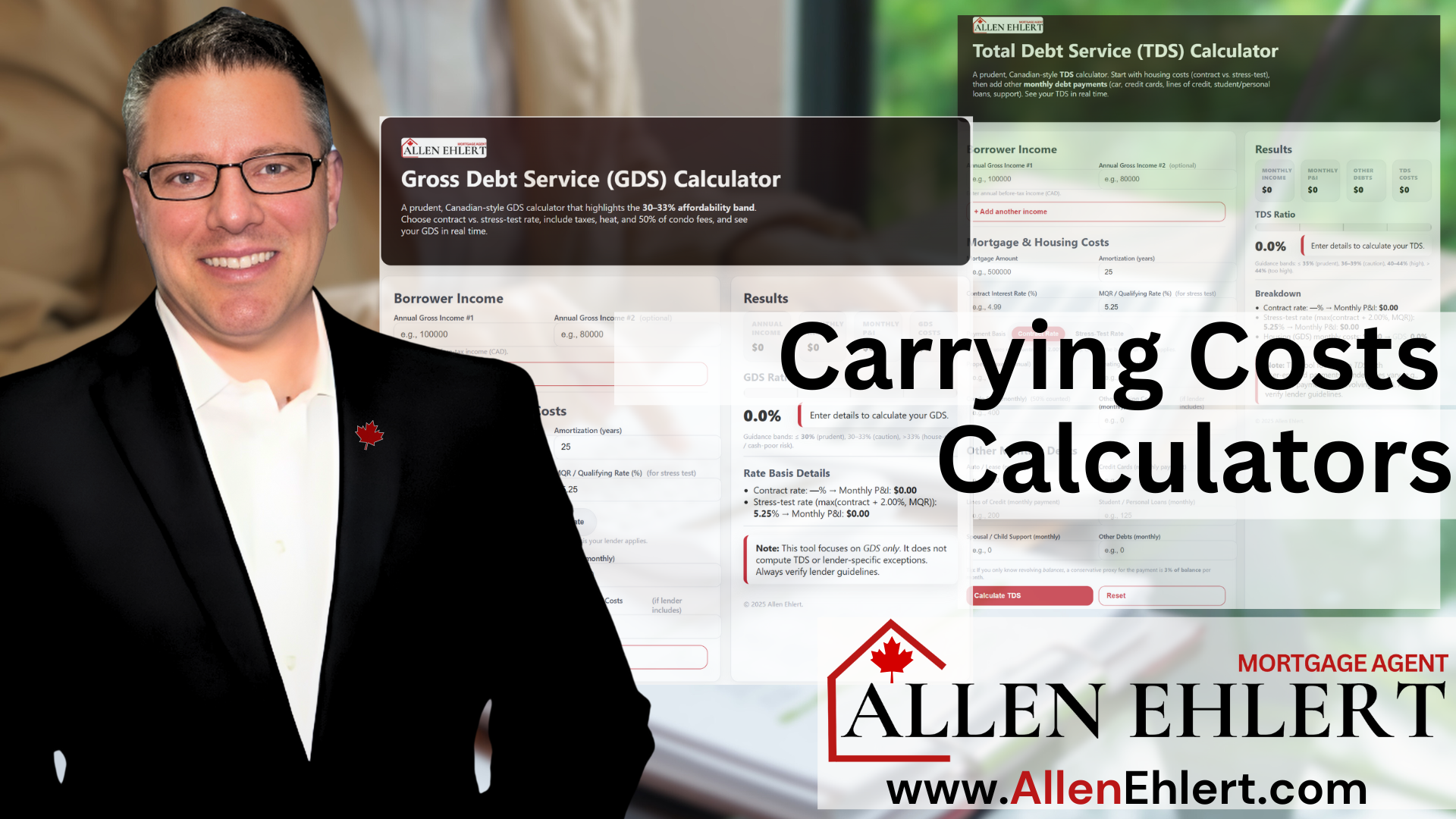

Canadian Home Carrying Cost Calculators

Canadian Home Carrying Cost Calculator: You’ve found the dream home: open-concept kitchen, backyard for summer BBQs, maybe even a finished basement for movie nights. The mortgage payment looks doable. But here’s the kicker: just because you can afford the payment doesn’t mean the bank will agree.

Ultimate Canadian Closing Costs Calculator

The Ultimate Canadian Closing Costs Calculator. This tool doesn’t just spit out a random number—it walks through all the hidden (and not-so-hidden) expenses that come with buying a home in Ontario. It accounts for the type of buyer you are, the kind of mortgage you’re getting, and every little adjustment in between.

“What’s Your Lowest Rate?”

Lowest Rate: If you’ve ever called a mortgage agent and led with the question, “What’s your lowest rate?”, you’re in good company — it’s probably the most common question in our industry. And honestly, I get it. Rates are tangible. They’re plastered all over billboards, bank websites, and radio ads.

Featured Publications

Articles

- Extended Amortizations and Hypothetical Calculations

Office of the Superintendent of Financial Institutions (OSFI) - Minimum Qualifying Rate for Uninsured Mortgages

Office of the Superintendent of Financial Institutions (OSFI) - Residential Mortgage Underwriting Practices and Procedures

Office of the Superintendent of Financial Institutions (OSFI) - Guideline on Existing Consumer Mortgage Loans in Exceptional Circumstances Financial Consumer Agency of Canada

Book: “The Program”

- Part 1 – Building Your Down Payment

- Part 2 – Mortgage Payoff Strategies

- Part 3 – Building Wealth Through Real Estate