Mortgage Articles

Your Way to Your Best Life!

Lenders and Being on Commission

If you’re earning your keep on commission — whether you’re slinging homes, closing car deals, or working your tail off in any other commission-heavy gig — you already know that explaining your income isn’t always simple. Some months you’re flush; others, not so much. But when it comes to getting a mortgage, how you get paid matters just as much as how much you get paid.

The Truth About “Limited Feature Mortgages”

We’ve all seen them — those ultra-low mortgage rates advertised by the big banks or online lenders. They’re tempting, no doubt about it. Who doesn’t want to save a few bucks on interest? But here’s what you might not realize: those “basic,” “no-frills,” or “limited feature” mortgages come with some fine print that can cost you more down the road than you save upfront.

Get Ready for Open Banking

Open Banking: If you’ve ever felt like getting a mortgage meant running an obstacle course—chasing down pay stubs, digging through old bank statements, sending documents back and forth—you’re not alone. The process can feel outdated, clunky, and stressful. But here’s the good news: change is on the horizon. It’s called Open Banking, and it’s going to flip the script on how we verify income, assets, and financial history.

Self-Employed? CMHC Can Help You Buy a Home

If you’re self-employed in Canada, you already know the drill: your income looks fantastic before your accountant works their magic. After write-offs and deductions? Not so much. That’s why so many business-for-self (BFS) clients feel like they’re being punished when it comes time to apply for a mortgage. Even though you might have great cash flow, solid savings, and strong financial habits, your “net taxable income” doesn’t always tell the full story.

Who Owns the Appraisal?

If you’ve ever gone through a mortgage process and found yourself wondering, “Wait, I paid for that appraisal—why won’t the lender give me a copy?” you’re not alone. This is one of the most common sources of confusion and frustration among homebuyers, homeowners, and even some realtors. It feels like you should have a right to it, right? After all, you footed the bill!

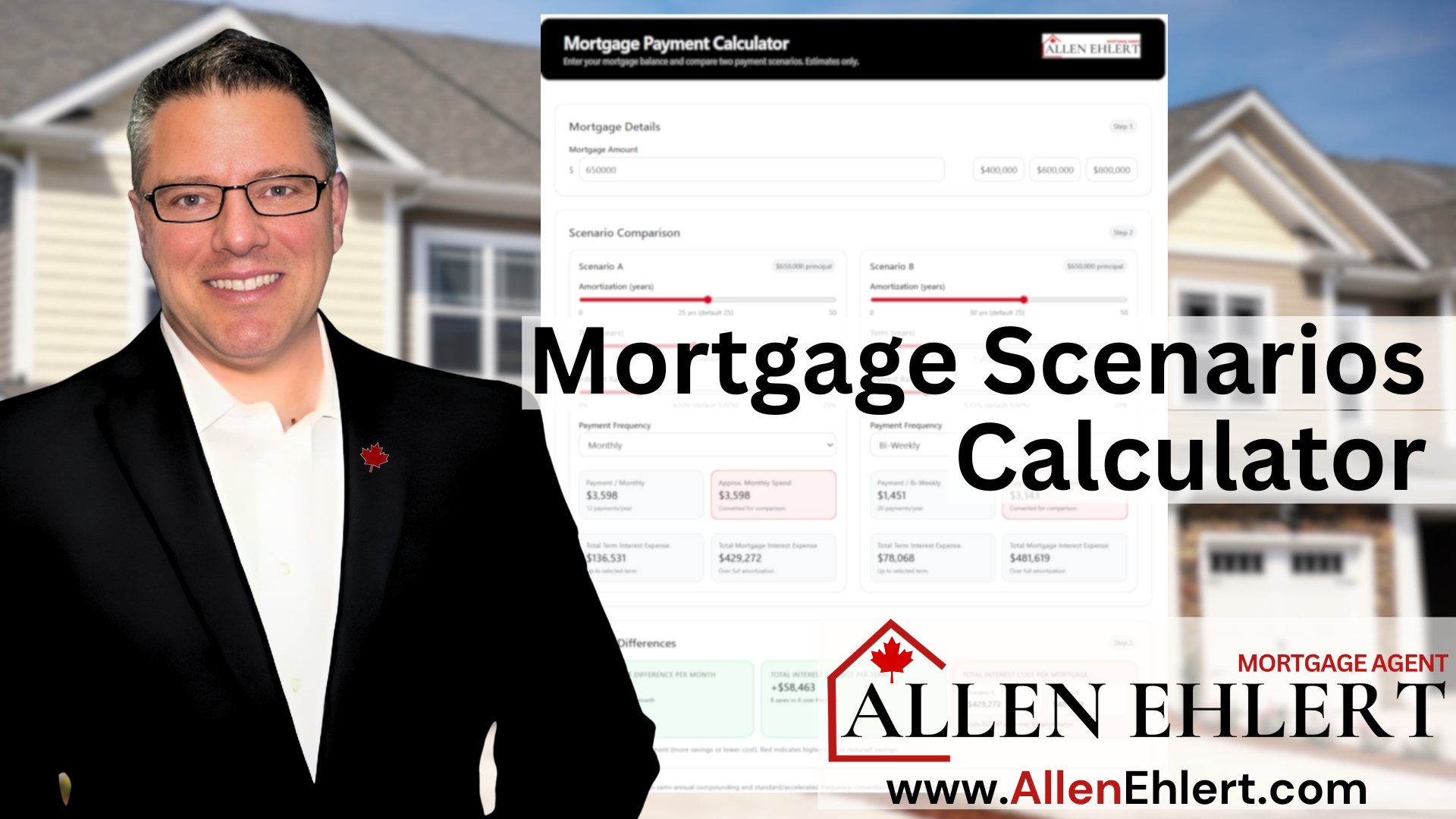

Ultimate Canadian Mortgage Payment Scenarios Calculator

Ultimate Canadian Mortgage Payment Scenarios Calculator. It’s not just about crunching numbers—it’s about putting you in the driver’s seat. You can run scenarios, compare your current mortgage to a new one, or even pit different lenders against each other. The best part? It shows you not only how your monthly payments stack up, but also how much interest you’ll save (or pay) over the term and the entire life of your mortgage.

Why Your Mortgage Rate is Tied to Bay Street

Ever wonder why mortgage rates seem to jump overnight even though you’ve done everything right? It can feel like the lender’s just making it up as they go along—but trust me, they’re not. What’s really happening behind the scenes is tied to something you might not think about: bonds and the capital markets.

Shelter Costs Unpacked

When you’re diving into the world of mortgages, the term “shelter costs” gets thrown around a lot. It sounds straightforward, right? Just your housing expenses. But what if you’re an adult—or maybe a couple—living in a home where your name isn’t on the mortgage or the title? That’s when things get a little more interesting.

Ultimate Canadian Bridge Financing Calculator

Bridge Financing Calculator: If you’ve ever bought and sold homes at the same time, you know it can feel like trying to juggle with oven mitts on. Point-to-point moves are fraught with danger, and they never come off without a hitch. So you get smart and decide you need bridge financing. Or maybe you’ve got your sale closing a week (or sometimes even a month) after your purchase, and the question hits: How the heck am I going to cover owning two properties at once if I even can?

Bank’s Collateral Mortgage Trap

Collateral Mortgage: When you sit down at a bank to sign your mortgage, everything sounds great. The rate seems OK, the approval was smooth, and the representative mentions, “We’re registering your mortgage as a collateral charge — that way, you’ll have room to borrow more later!”

Sounds harmless, right? Maybe even smart.

Getting Divorced? Need Help?

Mortgage and Divorce: Divorce isn’t just about splitting furniture and deciding who gets the dog. It’s about reshaping your financial life — often at lightning speed — and sometimes, the big banks just don’t play ball. If you’re navigating a separation and trying to keep or buy a home, you’ve probably already felt how rigid traditional lenders can be. That’s where alternative lenders step in — and that’s exactly where I, Allen Ehlert, Mortgage Agent, can make your life a whole lot easier.

ACE at Scotiabank

If you’ve ever been knee-deep in a mortgage application and suddenly heard someone at the bank say, “This needs to go to ACE,” you might have felt your stomach drop. Don’t worry—it’s not a bad thing. In fact, at Scotiabank, ACE stands for Adjudication Centre of Expertise, and it’s their in-house team that takes a second look at mortgage files that fall just outside the usual approval box.

Understanding EDD in Mortgage Underwriting

You’ve probably heard the phrase “the devil’s in the details”—and in the mortgage world, that detail often shows up as something called EDD, or Enhanced Due Diligence. It sounds intimidating, almost like you’re being audited, but it’s not what most people think.

The Panic of Falling Home Prices

Build more houses, prices drop, everyone wins. But here’s the kicker—prices are now dropping in many markets, and instead of celebration, there’s panic. Builders are pausing projects, policymakers are scrambling, realtors have no business, and homeowners are worrying about their equity.

American Financial Crisis in Canada?

What happened during the American financial crisis and could the stress test in Canada prevent the same crisis in Canada? The American financial crisis, commonly referred to as the Global Financial Crisis (GFC) of 2007-2008, was a severe worldwide economic crisis that...

Mortgages: Recognized Marriages from Outside of Ontario

In Ontario, Canada, in general, marriages that are legally recognized in the jurisdiction where they took place are typically considered valid in Ontario.

A Better Collateral Mortgage

Collateral mortgages have become the default product for many of Canada’s largest banks. The concept isn’t inherently bad—it’s just designed more for the lender’s convenience than for the borrower’s benefit. But what if it didn’t have to be that way? What if collateral mortgages were restructured to genuinely help homeowners while maintaining the flexibility lenders want?

Why Seniors Don’t Downsize

For decades, planners and real estate experts figured seniors would sell their big family homes, scoop up a condo, and ride off into a care-free retirement. But that’s not happening. Instead, most seniors are staying put—keeping their homes and choosing comfort, familiarity, and independence over the stress of moving.

Why Banks Can’t Just Lend Forever

You’ve probably heard people say, “Banks have all the money, what’s the problem?” It’s a common thought. After all, we trust banks to be solid, stable, and loaded with cash. But here’s something most homebuyers—and even some realtors—don’t fully understand: banks don’t have endless piles of money to hand out. Even the big guys are working within limits.

Rolling Out the Red Carpet for Foreign Buyers

There’s a new conversation heating up in real estate circles: What if we just opened the doors wide and invited foreign investors to buy up Canadian homes? For some in the home building industry, this is being pitched as a solution to sluggish sales—especially in the condo sector.

Commercial Lease Weaknesses

Weak Commercial Lease: When it comes to commercial real estate, you can have a great property, solid tenants, and even a healthy rent roll — but if your leases have hidden landmines, your financing could fall apart faster than you can say “commitment letter.”

Want to Pay Off Your Mortgage Faster?

If you’re like most homeowners, the thought of shaving years — and thousands of dollars in interest — off your mortgage is pretty appealing. You want that debt gone sooner so you can enjoy more freedom, more flexibility, and less financial pressure. The good news? You don’t have to win the lottery or double your income to do it. Sometimes, it’s as simple as tweaking how often you make your payments.

When a Lender Works in Your Favour

If you’ve ever had that sinking feeling after locking in a mortgage rate—only to see rates drop a few weeks later—you’re not alone. It’s one of the quirks of mortgage shopping: you want protection from rising rates, but you don’t want to be stuck paying more if rates take a dive.

Appraisal Nightmare: Falling Home Prices

Explore how new construction impacts your home’s value and what to do if the appraisal falls short in the current market.

Can a Lender Really Pull a Rate Hold?

If you’ve ever sat down with a client—or maybe you’re the one house hunting—and thought, “Phew, I’ve got my rate locked in, I’m good to go!”… I hate to break it to you, but it’s not quite that simple. There’s a lot of misunderstanding in the market around what a rate hold actually is, and more importantly, what it isn’t.

Commercial Leases and Mortgages

Commercial Lease and Mortgage: When it comes to commercial real estate, most people think of two separate worlds — the lease and the loan. One defines how a business occupies a property; the other defines how the property is financed. But here’s the truth that many overlook: these two worlds are deeply intertwined.

Why Big Banks Love Collateral Mortgages

Collateral Mortgage You know how it goes. You walk into a bank, they greet you with a smile, and before you know it, you’re pre-approved, papers in hand, and ready to sign. The banker casually mentions, “Oh, and your mortgage will be registered as a collateral charge—that’s just how we do things now.”

When Must Lenders Send Mortgage Renewal Offers in Canada?

Ever feel like your mortgage lender waits until the last possible minute to send you that renewal offer? You’re not imagining it. There’s actually a legal minimum for how much notice they need to give you, but that doesn’t always mean you’ll have a lot of time to weigh your options. If you’re coming up on your mortgage renewal and wondering what your rights are, you’re in the right place.

Hard vs Soft Credit Pull

Discover the impact of Hard vs. Soft Credit Pull on your score and how they affect your financial health in Canada. Stay informed with our guide.

Don’t Borrow to Buy!!!

RRSP Loans: You’ve probably seen the video clips on social media: someone cheerfully explaining how you can “stop using your own money” to buy a home. The idea sounds clever — borrow up to $50,000 from the bank, dump it into your RRSP, claim a juicy tax refund, then pull it back out 90 days later under the Home Buyers’ Plan (HBP) for your down payment. It’s marketed as a hack to get into the market faster, maybe even with “free money.”

Buying Out Your Ex: What Happens to the Mortgage During a Divorce?

“Hey Allen, I’m keeping the house, and I’m buying my ex out… What happens to the mortgage? Can I even afford it? Are there penalties?”

Let’s break it down step by step—with plain language, real talk, and expert insight—so you know what to expect if you’re the one staying put and buying your former partner out.

What’s Fair Market Rent?

If you’ve ever tried to use rental income — from a basement apartment, duplex, or investment property — to help you qualify for a mortgage, you’ve probably heard the term “Fair Market Rent.” It sounds official because it is. But it’s also one of those terms that can catch people off guard if they’re not properly prepared.

The Depreciating Canadian Dollar

Depreciating Dollar. Let’s talk about something that’s been quietly eating away at Canadians’ financial future — purchasing power. Sure, your income might rise over time, and the news might say inflation’s “under control.” But if you’ve ever wondered why your parents could buy a house on one income while you’re grinding just to save a down payment, the answer isn’t as simple as the Consumer Price Index (CPI).

What is a Purchase Plus Improvements Mortgage?

Unlock the potential of home ownership and renovations with a Purchase Plus Improvements Mortgage – finance your property and upgrades together.

Top Credit Score Myths

Discover the truth about Credit Score myths and learn how to gauge your creditworthiness accurately for better financial health.

Certificate of Pending Litigation

A Certificate of Pending Litigation (CLP) is a legal document that is registered against the title of a property to indicate that there is a pending lawsuit involving the property.

Investing in Tenanted Property in Ontario

Explore the nuances and benefits of investing in Tenanted Property across Ontario for steady income and long-term returns.

Featured Publications

Articles

- Extended Amortizations and Hypothetical Calculations

Office of the Superintendent of Financial Institutions (OSFI) - Minimum Qualifying Rate for Uninsured Mortgages

Office of the Superintendent of Financial Institutions (OSFI) - Residential Mortgage Underwriting Practices and Procedures

Office of the Superintendent of Financial Institutions (OSFI) - Guideline on Existing Consumer Mortgage Loans in Exceptional Circumstances Financial Consumer Agency of Canada

Book: “The Program”

- Part 1 – Building Your Down Payment

- Part 2 – Mortgage Payoff Strategies

- Part 3 – Building Wealth Through Real Estate