The Economy

Get the Big Picture!

How Canada’s Prime Rate Impacts You

Explore how Canada’s Prime Rate affects your mortgage, investments, and savings. Stay informed and manage your finances with confidence.

Why Canada Needed the Mortgage Stress Test?

Why was it necessary for OSFI to mandate the implementation of the mortgage stress test? The Office of the Superintendent of Financial Institutions (OSFI) mandated the implementation of the mortgage stress test in Canada for several key reasons, primarily aimed at...

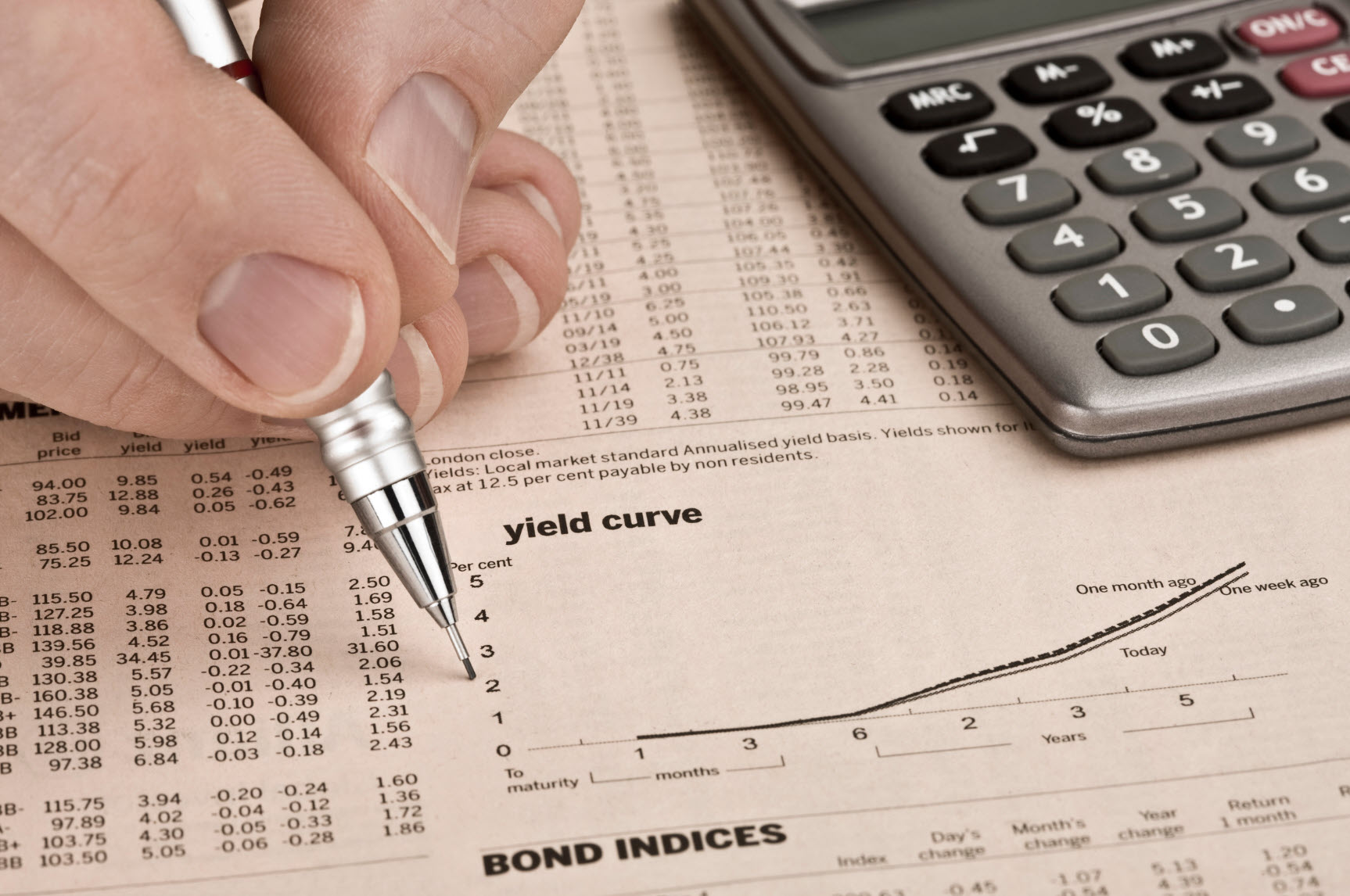

The Inverted Yield Curve Omen

Demystifying the Inverted Yield Curve Phenomenon Have you ever wondered why investors are so obsessed with the inverted yield curve? Let's dive into the world of finance and understand why this concept holds such significance in predicting economic trends. What is the...

Taxed to the Rafters

If it feels like your paycheque doesn’t stretch as far as it used to, you’re not imagining things. Canadians today spend more on taxes than on food, shelter, and clothing combined—the very basics of living. According to the Fraser Institute’s Canadian Consumer Tax Index (2025), the average family hands over more than 43% of its income to taxes, while only about 36% goes to life’s necessities.

Who’s Buying Real Estate Right Now?

If you’ve been chatting with clients or colleagues lately, you’ve probably noticed that the question on everyone’s mind is: Who’s actually buying real estate right now? It’s a fair question. The headlines are full of doom and gloom about affordability, interest rates, and a supposed ‘market freeze’ — yet deals are getting done.

How the Bank of Canada Steers the Economy

Decoding How the Bank of Canada Influences the Economy Using its intricate workings, let's get into how the Bank of Canada steers interest rates to shape the entire economy. From influencing borrowing costs to guiding inflation, the BOC's policies have a profound...

Are You the Missing Middle?

Let’s cut to the chase—owning a home in the Greater Toronto Area used to be a realistic goal for middle-income Canadians. Now? Not so much. If you’re earning a decent salary but still can’t afford to buy (or even rent without stress), you’re probably part of a growing group called the “missing middle.” This article will walk you through what that means, who’s affected, why it’s happening, and what you can do about it—especially when it comes to mortgages.

Canada’s Financial Snapshot

Whether you’re renewing, refinancing, or getting ready to jump into homeownership, let’s sit down and chat about something that directly affects your financial future: Canada’s financial landscape. Think of this as our casual coffee chat—packed with important info, minus the confusing jargon.

Why Can’t We Build Homes

“Supply, supply, supply.”

If you’ve spent any time in the world of Canadian housing policy—or if you’ve even just watched the evening news—you’ve probably heard that phrase tossed around as the magic bullet to solve our housing crisis. But here’s the real question: If we all agree that we need more homes, why can’t we just build them?

Hidden Housing Costs: Provincial Downloading

We talk a lot about high home prices in Ontario—land costs, construction costs, interest rates. But there’s a quieter, less visible factor that doesn’t get enough airtime: provincial downloading.

In plain terms, downloading is when the provincial government offloads responsibilities and costs onto municipalities—without providing the funding to go with it. And when municipalities are left holding the bill, they turn to one of the few revenue tools they have: development charges.

Provinces Make Housing Expensive

If you’ve ever wondered why Ontario’s cities are straining to pay for everything from public housing to transit to stormwater pipes, the answer lies in a quiet but powerful political strategy called “downloading.” It’s the art of pushing responsibility down the ladder—without sending the dollars to match.

The Dash for Cash

In the Bank of Canada Staff Discussion Paper 2025-5, titled Will Asset Managers Dash for Cash? Implications for Central Banks, economic researchers discuss how asset managers play a crucial role in financial markets, managing trillions of dollars in securities and...

Why Listings Are Killing the Market

The Paradox of Choice is a concept popularized by psychologist Barry Schwartz in his book “The Paradox of Choice: Why More Is Less.” It refers to the phenomenon where having too many options leads to decision paralysis, increased anxiety, and dissatisfaction—rather than greater freedom or happiness.

Are House Prices Too High?

You don’t need to be a real estate expert to feel it: house prices seem out of reach for the average family. But why? What’s keeping prices so high when affordability has clearly left the building? As someone who gets into roughly a hundred homes every month, I’ve had a front-row seat to the push and pull of today’s housing market—and let me tell you, it’s a fascinating, frustrating, and complex story.

Natural Disasters, Inflation, and Housing Affordability

Canada is no stranger to natural disasters. From wildfires in British Columbia to severe floods in Ontario and Quebec, extreme weather events are becoming more frequent and costly. Beyond their immediate devastation, these disasters also have long-term economic...

How to Control Inflation with Interest Rates

Let's explore the intricate relationship between interest rates and inflation, and how central banks utilize interest rates as a key weapon in their arsenal to control inflation. We will unravel the complexities and real-world implications of interest rate...

Featured Publications

Articles

- Extended Amortizations and Hypothetical Calculations

Office of the Superintendent of Financial Institutions (OSFI) - Minimum Qualifying Rate for Uninsured Mortgages

Office of the Superintendent of Financial Institutions (OSFI) - Residential Mortgage Underwriting Practices and Procedures

Office of the Superintendent of Financial Institutions (OSFI) - Guideline on Existing Consumer Mortgage Loans in Exceptional Circumstances Financial Consumer Agency of Canada

Book: “The Program”

- Part 1 – Building Your Down Payment

- Part 2 – Mortgage Payoff Strategies

- Part 3 – Building Wealth Through Real Estate