For anyone interested in real estate—whether you’re a realtor, a financial professional, or a homebuyer—condominiums represent a significant portion of the housing market, especially in urban centres. However, not all condos are created equal. Some condos in Canada end up on what’s commonly referred to as a blacklist maintained by lenders. Blacklisted condos are buildings deemed too risky for mortgage financing, creating substantial challenges for buyers, sellers, and even current owners.

If you’re thinking of purchasing or selling a condo, it’s essential to understand what a blacklisted condo is, why it might be blacklisted, and what to do if you encounter one. This knowledge can save you from costly mistakes and help ensure your transactions are smooth and successful.

Key Reasons for a Condo to be Blacklisted

Real-World Examples of Blacklisted Condos

Implications of a Blacklisted Condo

How to Identify a Blacklisted Condo

What to Do If You Own a Blacklisted Condo

How to Avoid Purchasing a Blacklisted Condo

What Is a Blacklisted Condo?

A blacklisted condo is a condominium that certain mortgage lenders have categorized as high-risk and are unwilling to finance. Lenders maintain these lists to protect themselves from potential financial losses, as blacklisted condos typically face issues that could affect their value or marketability. While lenders’ lists are private and vary, the reasons for blacklisting tend to be consistent.

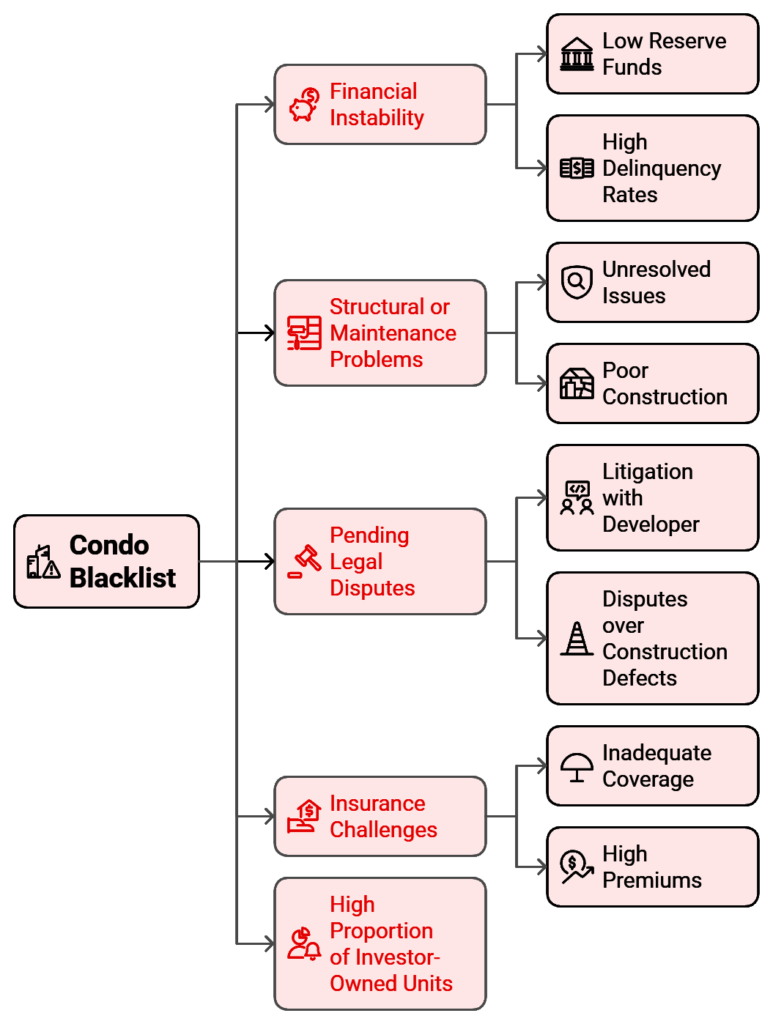

Key Reasons for a Condo to Be Blacklisted

Understanding why a condo may end up on a blacklist is crucial, as it can affect your decision to buy or sell. Here are the primary reasons:

- Financial Instability of the Condo Corporation

- Structural or Maintenance Problems

- Pending Legal Disputes

- Insurance Challenges

- High Proportion of Investor-Owned Units

Financial Instability of the Condo Corporation

Lenders are wary of condo corporations with insufficient reserve funds, high debt, or poor financial management.

Read More: Understanding Condo Reserve Funds

If the condo’s reserve fund—a pool of money set aside for major repairs and maintenance—is low, lenders perceive it as a red flag.

High delinquency rates among unit owners (e.g., unpaid maintenance fees) can also indicate financial instability and make a condo more likely to be blacklisted.

Structural or Maintenance Problems

Unresolved maintenance issues, such as water damage, mould, or other structural defects, are serious concerns for lenders.

If a building has received multiple complaints from owners about ongoing problems or has a history of repair issues, it may be labelled high-risk.

In extreme cases, buildings with significant structural issues, such as those arising from poor construction, can make lenders completely unwilling to finance purchases within that building.

Pending Legal Disputes

If the condo corporation is involved in ongoing legal battles—whether it’s litigation with the developer, disputes over construction defects, or conflicts with owners—lenders may consider it too risky.

Legal disputes can increase costs and liabilities for owners, further complicating mortgage approvals.

Insurance Challenges

A condo building struggling to maintain adequate insurance coverage or facing high insurance premiums may be blacklisted.

Insurance difficulties suggest a higher likelihood of major claims, which could impact the condo’s financial stability and market value.

High Proportion of Investor-Owned Units

If a significant percentage of units in a building are rented out rather than owner-occupied, lenders may perceive it as more volatile.

This is particularly true if a building has a high proportion of short-term rental units (e.g., Airbnb), as these can reduce the perceived stability of the condo’s value.

Real-World Examples of Blacklisted Condos

Example 1: Toronto High-Rise with Structural Issues

A high-rise condo in downtown Toronto was blacklisted by several major banks due to persistent issues with its plumbing and electrical systems. These problems led to costly repairs that drained the building’s reserve fund, resulting in lenders refusing to provide financing to prospective buyers.

Example 2: Vancouver Condo Facing Lawsuits

In Vancouver, a condo was blacklisted after the condo corporation filed a lawsuit against the developer for structural defects related to the building’s foundation. The ongoing legal proceedings, coupled with concerns about the cost of repairs, made lenders classify it as high risk.

Implications of a Blacklisted Condo

Owning, selling, or attempting to buy a blacklisted condo comes with significant challenges:

- Difficulty in Obtaining Financing

- Impact on Property Value

- Challenges in Selling

Difficulty in Obtaining Financing

Prospective buyers may struggle to secure mortgage approvals for blacklisted condos, limiting the pool of potential buyers.

Current owners looking to refinance may also face hurdles, as lenders may be unwilling to approve a new mortgage or offer less favourable terms (e.g., higher interest rates, shorter terms).

Impact on Property Value

A building’s blacklisted status can lower the value of its units, as the limited access to financing reduces demand.

Even if financing is available, buyers may face higher down payment requirements (e.g., 20-30%) and increased interest rates, making the property less attractive.

Challenges in Selling

Sellers may face longer timeframes and may have to lower their asking price to attract cash buyers or those willing to navigate the complex financing landscape of blacklisted condos.

How to Identify a Blacklisted Condo

While lenders don’t make their blacklists public, there are steps you can take to identify potential issues before committing to a purchase:

- Review the Status Certificate Carefully

- Speak with a knowledgeable Mortgage Agent

- Consult with the Property Management Company

Review the Status Certificate Carefully

The status certificate provides a comprehensive overview of the condo’s financial health, legal standing, and other pertinent information.

Key things to watch for:

- Reserve fund balance: A low reserve fund can indicate financial instability.

- Recent special assessments: Frequent assessments could signal unresolved maintenance or funding issues.

- Pending legal matters: If there are lawsuits involving the condo corporation, investigate further to understand the potential impact.

Speak with Your Mortgage Agent

Experienced mortgage agents often have insight into which buildings are considered high-risk by lenders. They can also help you interpret the status certificate and advise on how it may impact your financing options.

Mortgage agents have professional relationships with lenders’ BDMs (business development managers) who have access to their lender’s blacklist. Mortgage agents can find out if the condo you are interested in is on a lender’s blacklist or not.

Consult with the Property Management Company

Ask detailed questions about the building’s financial status, major repairs, and any potential risks that could affect your ability to secure financing.

What to Do If You Own a Blacklisted Condo

If you already own a blacklisted condo, there are steps you can take to improve your situation:

- Improve the Condo’s Financial Standing

- Work with a Specialized Mortgage Broker

- Consider Selling to a Cash Buyer

Improve the Condo’s Financial Standing

Work with your condo board to address financial issues, such as increasing the reserve fund or implementing better financial management practices.

Encourage transparency with owners about the building’s financial health and needed repairs, as this can help attract potential buyers.

Work with a Specialized Mortgage Agent

If you’re looking to refinance, a mortgage agent specializing in alternative lending may be able to connect you with B lenders or private lenders willing to finance blacklisted condos, albeit at higher rates and fees.

Consider Selling to a Cash Buyer

If refinancing proves too difficult or costly, you may need to market your condo to cash buyers who are not reliant on mortgage approval.

How to Avoid Purchasing a Blacklisted Condo

When considering a condo purchase, here are actionable steps to reduce the risk of buying a blacklisted property:

- Conduct Thorough Due Diligence

- Look for Strong Financials

- Consider Location and Market Trends

Conduct Thorough Due Diligence

Don’t rely solely on listings; conduct detailed checks, review the status certificate, and ask the right questions.

Look for Strong Financials

Focus on buildings with a well-funded reserve, low delinquency rates, and a history of sound financial management.

Consider Location and Market Trends

Some buildings in rapidly appreciating markets may face fewer financing challenges, as increased value can offset lenders’ risk.

Navigating Blacklisted Condos

If you’re considering buying, selling, or refinancing a condo, here’s what to do next:

- Conduct a detailed review of the status certificate to understand potential risks.

- Work with experienced professionals, such as Allen Ehlert and lawyers, to navigate the complexities.

- Explore alternative lending options if traditional financing is not available and be prepared for potential trade-offs.

Summary

Understanding blacklisted condos is critical for anyone involved in real estate transactions. By knowing what to look for, how to address potential issues, and when to seek expert advice, you can make more informed decisions and minimize financial risk. Whether you’re buying, selling, or advising clients, the knowledge of blacklisted condos can be a powerful tool in your real estate toolkit.