… Your Bank App Shows Your Credit Score… But Should You Trust It?

I had to walk into a local bank branch the other day because the ATM machines weren’t working. While waiting in line for the only teller on duty, I noticed on a big screen TV advertising all kinds of bank products and offerings, including a new tool on the Bank’s app that would give you your credit score. Hmmm…. Interesting, I thought.

You’ve probably noticed it: Canadian bank apps are turning into little financial command centres. Budgets, spending insights, alerts—and now credit score tools baked right into the app. On the surface, it feels like a win: quick access, no cost, and you don’t have to sign up for a separate service.

But here’s the truth: these tools are genuinely helpful in some situations—and genuinely misleading in others. The key is knowing when the score is “close enough” and when it’s not.

What I’ll Cover

Credit score tools in Canadian banking apps today

Why banks added these tools (and why you like them)

Consumer-facing scoring models vs lender-grade scoring models

When the score doesn’t matter much (outstanding credit scenarios)

When the score becomes unhelpful (near the margin)

A story that shows how this plays out

How realtors and clients can use these tools the right way

How to use bank-app credit tools without getting misled

Credit Score Tools in Canadian Banking Apps Today

Across Canada, several major banks now provide credit score access inside mobile and online banking. Most of these tools are powered by TransUnion dashboards (often branded as CreditView), though implementations vary by institution.

TD Canada Trust: TransUnion CreditView in the TD App

TD offers a TransUnion CreditView® Dashboard inside the TD app, letting you check your score without impacting it (a soft inquiry). It’s positioned as a way to monitor credit health and spot changes over time.

Scotiabank: TransUnion Credit Score Tool

Scotiabank customers can enroll to view a TransUnion-based credit score tool, with ongoing access and no impact to the score. Scotia’s materials also reference the ability to track history and view report-style details.

RBC: Credit Score in RBC Mobile (TransUnion CreditView)

RBC offers free credit score access through RBC Online Banking / RBC Mobile, tied to TransUnion CreditView. The bank frames it as secure, convenient, and non-impactful to your score.

BMO: Credit Coach

BMO’s “Credit Coach” is a built-in credit score and education tool, positioned around monitoring, alerts, and guidance. (BMO’s content also emphasizes soft-check monitoring.)

CIBC: Free Credit Score Service (CreditView / CreditVision Risk Score)

CIBC provides a free credit score feature for clients in digital banking. Their materials describe a “CreditVision® Risk Score,” score trending, alerts, and a simulator. CIBC documentation also references bureau sourcing (their own pages have referenced Equifax and/or TransUnion depending on the page/version), which is a good reminder that providers and implementations can evolve.

Tangerine: “Credit Score” Tool (TransUnion)

Tangerine offers a built-in credit score tool and notes the score is displayed using TransUnion scores “as a convenience.”

Why Banks Added These Tools (And Why You Like Them)

Let’s be honest: you don’t open your banking app because you’re bored. You open it because you’re trying to stay on top of your life.

These tools are popular because they’re:

- Frictionless (already in your app)

- Free

- Non-damaging (soft pull)

- Easy to interpret (score, trendline, simple tips)

And for many Canadians, that’s a legitimate upgrade from the old days of “your credit score is a mystery unless you pay for it.”

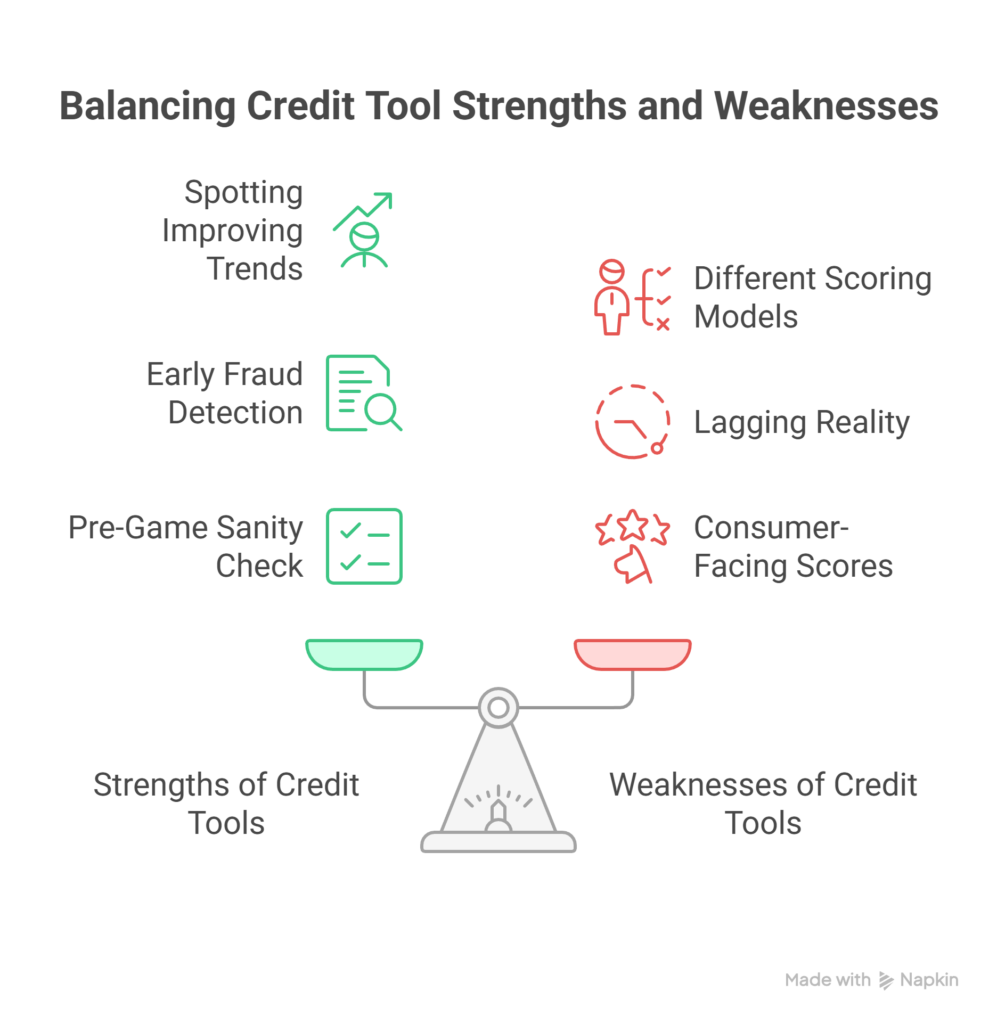

Where These Tools Are Strong

They’re Great for Spotting Trends

If your score is moving from, say, 715 → 735 over a few months, that’s meaningful. Not because the exact number is sacred—but because the direction tells you your habits are improving.

They Can Help You Catch Fraud or Reporting Weirdness Earlier

Many of these dashboards include alerts or monitoring features. If something pops up that you didn’t authorize, you’re finding out sooner—when you can actually do something about it. (Banks commonly frame the tool this way, and it’s one of the most practical benefits.)

They’re Good “Pre-Game” Tools

Before you apply for a mortgage, these tools can help you sanity-check:

- Are balances high?

- Is utilization creeping?

- Did you miss a payment?

- Are there new accounts you don’t recognize?

In other words: they help you walk into the process less blind.

Where These Tools Are Weak

They Often Use Consumer-Facing Scoring Models

Here’s the part most people don’t get told clearly:

The score you see in your bank app is often a consumer-facing score designed for monitoring and education. It’s a valid score—but not necessarily the same score (or model) used in mortgage underwriting.

Banks themselves emphasize the score is a soft check / monitoring view.

Different Score Models = Different Numbers

Even when the bureau is the same, credit scoring can vary because:

- The model version can differ

- The weighting can differ

- The product/lender can use a different risk lens

So two things can be true at once:

- Your bank app score is “real”

- Your mortgage lender can still see something meaningfully different

They Can Lag Reality

Some tools update on a schedule (often monthly trends are emphasized). That means a score can look stable while your file has changed recently—utilization spikes, a new inquiry, a new tradeline reporting, etc.

The Big Issue: Consumer-Facing Scores vs Lender-Grade Scores

Think of it this way:

Consumer-facing scoring models are designed to help you understand your credit and stay engaged.

Lender-grade scoring models are designed to help lenders predict risk on a specific product—like a mortgage.

They can evaluate the same file differently because they’re answering different questions.

So if you want to check your credit score to help you understand your credit then these are really good tools.

If you want to know if you’ll be approved for a loan, not so much.

Wait… did your bank disclose this to you?

Credit Works in Bands

Most people assume credit scores work like a sliding scale, where every point is treated more or less the same. In reality, mortgage underwriting works in bands. Lenders group credit scores into ranges, and each range comes with its own rules, rates, and options. Being safely inside a band usually means smoother approvals and better pricing.

But being just a few points outside a band—especially around insured versus uninsured mortgage cutoffs—can completely change the outcome. In Canada, insured mortgages generally allow for lower minimum credit scores because the lender’s risk is backed by mortgage default insurance. Uninsured mortgages, on the other hand, typically require higher scores and offer less forgiveness.

If your score falls just below an uninsured cutoff, you may face a higher rate, fewer lender options, or be pushed into insured or alternative lending—even though, to you, the score still “looks good.”

Example:

Here’s how this plays out in real life. Imagine two buyers purchasing similar homes with the same income and down payment. One borrower’s lender-grade credit score comes in just inside the uninsured band, unlocking a competitive uninsured rate. The other borrower’s score lands just a few points lower—barely outside that band. That small difference can mean paying a noticeably higher interest rate, needing mortgage default insurance, or even being declined by certain lenders altogether.

From the borrower’s perspective, the scores feel almost identical. From the lender’s perspective, they fall into two completely different risk categories.

This is why credit scores shown in bank apps can be reassuring—but also misleading—when you’re close to the line. The exact number matters far less than which band you fall into on the day your mortgage is underwritten, and that’s something an app score can’t reliably tell you.

When the Score Doesn’t Matter Much

If your credit is truly excellent—clean history, low utilization, long-established tradelines—then small differences between models don’t usually change your outcome.

In that world:

- You’re well above typical thresholds

- A 10–25 point model gap is mostly noise

- The approval is more about income, ratios, property, and documentation

So yes—if you’re sitting comfortably in “strong credit territory,” these app tools are very useful as maintenance and monitoring.

When the Score Becomes Unhelpful: Near the Margin

Now we get into the danger zone.

When you’re near a cutoff (people commonly feel it around “high 600s”), the bank-app score can give false confidence because:

- The model may be less sensitive to certain risk signals

- The update timing may lag

- The lender may use a different score version

- The lender cares about the structure of your file, not just the number

Near the margin, the question isn’t:

“What’s my score today in the app?”

It’s:

“What does my file look like under a lender-grade lens—right now—if I apply?”

That’s where borrowers get burned:

- They think they’re safe because the app says “good”

- Then they find out underwriting sees a thinner buffer—or no buffer at all

A Story That Happens All the Time

You’re working with a buyer—let’s call him Mike. He’s proud of himself: paid down debt, cleaned up old issues, and his bank app is showing a score he feels good about.

He goes house hunting, finds “the one,” and you start the mortgage process.

Then underwriting comes back tighter than expected.

Why?

Because in the last 60–90 days:

- Mike carried higher balances (utilization spiked)

- He applied for a new card “for points”

- A couple accounts reported later than his app refreshed

His app score wasn’t “wrong.”

It was just not the right instrument for a high-stakes lending decision at that moment.

And in that margin zone, small differences become big consequences.

How Realtors and Clients Can Use These Tools the Right Way

For Clients

Use the bank app credit tool to:

- Track trends (up/down over months)

- Catch surprises early (fraud/errors)

- Build awareness of utilization and payment habits

But don’t use it to:

- Assume mortgage readiness near a cutoff

- Make timing decisions on applications without guidance

- Treat the app score like the underwriting score

For Realtors

This matters because your buyer’s confidence can be misleading.

A practical realtor approach:

- When a buyer says “my score is good,” respond with:

“Perfect—let’s have your mortgage agent confirm what that means for lending, not just monitoring.”

That keeps the deal from collapsing late due to credit surprises.

How to Use Bank-App Credit Tools Without Getting Misled

1st: Use the score to monitor direction, not perfection.

2nd: Watch utilization like a hawk if you’re planning a purchase or refinance.

3rd: Avoid new credit applications in the run-up to mortgage qualification.

4th: Treat “near the margin” as a planning problem, not a guessing game.

5th: When it’s go-time, get an expert to interpret your full file—not just the number.

Allen’s Final Thoughts

Bank-app credit tools are a net positive for Canadians—no question. They make credit less mysterious, they help you spot issues sooner, and they encourage healthier habits. TD, Scotia, RBC, BMO, CIBC, and Tangerine all offer some form of built-in access now, and that convenience is real.

But you’ve got to keep it in perspective: a consumer-facing score is a monitoring tool, not a mortgage decision tool. If your credit is outstanding, the exact model differences usually don’t change your life. If you’re close to the line, though, those differences can be the difference between “approved” and “not quite,” or between prime options and a more expensive path.

And that’s where I come in. As your mortgage agent, I can look at the bigger picture—your credit structure, timing, lender appetite, and strategy—so you’re not betting a home purchase on a number in an app. If you’re thinking about buying, renewing, refinancing, or cleaning up credit before making a move, book a call and we’ll map out the smartest path forward—before the stakes get expensive.