…Why That Little Piece of Paper Packs a Big Punch

Grab a coffee, because we’re about to connect the dots between the Master Business License (MBL) you filed away somewhere in a desk drawer and the mortgage you’ve been eyeing. Spoiler alert: lenders care about that slip of paper more than you might think, and knowing how to wave it around—figuratively, of course—can save you headaches, heartaches, and higher interest rates.

Topics I’ll Cover

What Exactly Is a Master Business License?

Why Your MBL Matters to Mortgage Lenders

How to Get (and Keep) an MBL in Ontario

Putting It Into Practice: Real-World Self-Employed Examples

Elements That Impact a Mortgage Application

What Exactly Is a Master Business License?

Your Master Business License is the province’s way of saying, “Yup, this business name exists and belongs to you.” Think of it as a learner’s permit for entrepreneurship: inexpensive, easy to get, but mandatory if you’re operating under anything other than your own legal name. It doesn’t shield you from liability like a corporation does, but it does give you the right to deposit cheques made out to “Squeeky Clean Windows” instead of “Jamie Wilson.”

Colloquial takeaway: It’s the duct tape of small-biz paperwork—cheap, versatile, and lenders want to see it holding the pieces together.

NOTE: While it is still commonly called a Master Business License (MBL), it is issued under it’s proper name: Business Name Registration.

See Details Here

Ontario’s Business Names Act requires anyone carrying on business under a name that is not exactly their own legal name to register that name. The registration document—still colloquially called a Master Business Licence (MBL) but now issued as a Business Name Registration—is valid for five years.

Banks will ask for the current MBL/Business Name Registration as proof the business exists, plus government-issued ID for the owners. Most large banks also want a CRA Business Number (BN)—you can get one online in a few minutes.

Why Your MBL Matters to Mortgage Lenders

Mortgage underwriters are basically professional skeptics. When your paycheque isn’t coming from a tidy T4 slip, they need extra proof that your business is:

- Legit – An active MBL shows you didn’t just cook up a business name last week for loan purposes.

- Stable – Renewal dates tell lenders the business has some mileage; an expired MBL raises eyebrows (and sometimes interest rates).

- Separate – Bank statements in the business name help them trace revenue cleanly, so your side hustle doesn’t look like random e-transfers from Aunt Sally.

Bottom line? Flashing a current MBL is like showing ID at the door. No MBL, no entry—at least not without a pile of extra paperwork.

How to Get (and Keep) an MBL in Ontario

Ready for the “how-to” play-by-play?

First, hop onto the Ontario Business Registry, search to make sure your dream name isn’t already spoken for, and complete the Business Name Registration form (about fifteen minutes and sixty bucks if you’re paying online).

Second, download the PDF copy the portal spits out. Save it in at least three places—laptop, cloud, and a snazzy folder labelled “Important!”

Third, walk that MBL into your bank. Open a business chequing account so deposits match the name on invoices and, crucially, the name underwriters will see.

Fourth, set a calendar reminder four years and nine months from now (yes, really). Renew before the five-year mark so your license doesn’t lapse the week you’re making an offer on a house.

Putting It Into Practice: Real-World Self-Employed Examples

Let me provide you with 3 different scenarios that describe how a master business license can be used:

Squeeky Clean Windows (Sole Prop)

You register the name, funnel all payments through the new business account, and two years later your T1 Generals show rising net income. Lender sees tidy statements + current MBL = quick approval for that triplex you’ve been eyeing.

Beaver-Byte Web Design (Partnership)

Two buddies split profits 50/50. You each file returns with your share of business income, keep the MBL renewed, and voilà—underwriters can match invoices back to the partnership bank account instead of sorting through personal e-transfers.

Maple Wellness Coaching Inc. (Corporation + Trade Name)

You incorporated for liability reasons. “Maple Wellness” is the MBL, while “12345678 Ontario Inc.” is the legal shell. You pay yourself a salary plus dividends. Lenders love the clear separation: corporate financials, personal T4, and that trusty trade-name registration.

Elements That Impact a Mortgage Application

| Element | Why It Matters |

| Personal Credit Score | Even rock-solid business income can’t outrun a weak Beacon score. |

| Two-Year Average Income | Lenders average your net taxable income (plus add-backs) from the past two years’ tax returns. |

| Business Longevity & Licensing | Current MBL or articles of incorporation prove operational history. |

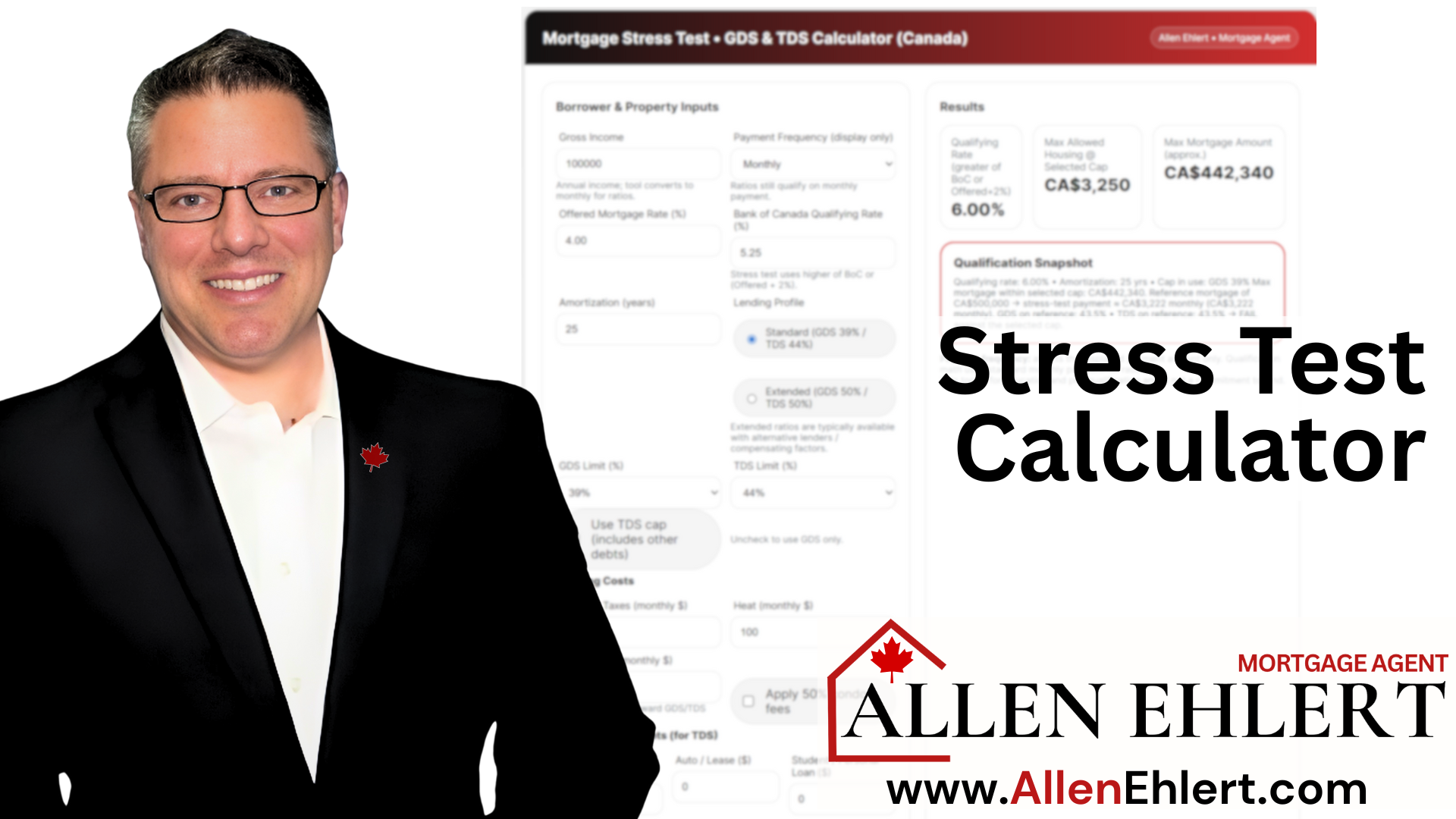

| Debt Service Ratios (GDS/TDS) | Your gross and total debt service ratios need to fit guidelines—typically under 39% and 44% for prime lenders. |

| Down Payment Source | Savings, RRSP withdrawal, gifted funds, or retained earnings—must be tracked for 90 days. |

| Business Banking Hygiene | Clean, consistent deposits into a business account lend credibility and make income verification painless. |

| Liability Protection | If you’re incorporated, lenders look at “corporate GDS/TDS” too—retained earnings vs. shareholder loans. |

Allen’s Final Thoughts

Mortgage rules can feel as slippery as a rainy-day job washing third-floor windows—but they don’t have to knock the ladder out from under you. Keep your Master Business License current, separate business and personal cash flow, and show lenders you’re not just running a hobby but a bona-fide cash-generating machine.

And hey, that’s where I come in.

As a licensed mortgage agent who nerds out on self-employment nuances, I can:

- Review your business docs to spot red flags before an underwriter does.

- Suggest legit “add-backs” (vehicle write-offs, depreciation) to boost qualifying income.

- Pair you with lenders comfortable with sole props, corporations, or even that quirky seasonal cash flow.

- Map out a timeline—MBL renewal, CRA filings, bank account clean-up—so you hit “apply” when your file is sharp.

Ready to turn your window-cleaning (or coaching, designing, baking, or consulting) hustle into keys for a new home? Let’s chat. I’m here to climb the ladder alongside you—squeegee in hand, loan options at the ready, and a clear view of your financial future.