… The Truth in Writing: Why Estoppel Certificates Can Make or Break Your Commercial Deal

If you’ve ever been involved in financing a commercial property—especially one with tenants—you’ve probably heard someone mention an estoppel certificate. It’s one of those documents that sounds a bit old-fashioned, but in the world of commercial mortgages, it’s pure gold.

Lenders love them, lawyers depend on them, and smart investors never close a deal without them. Why? Because an estoppel certificate is the tenant’s written confirmation that everything in the lease is exactly as it appears—no hidden side deals, no unpaid rent, no unexpected promises lurking in the background.

In short, it’s the document that turns “We think we know” into “We’re sure we know.”

Let’s unpack what estoppel certificates are, why lenders and buyers rely on them, and how understanding this simple concept can save you (and your clients) from major headaches down the road.

Topics I’ll Cover

What an Estoppel Certificate Is

What’s Included in an Estoppel Certificate

How It Protects Buyers, Borrowers, and Lenders

A Real-World Story: The Case of the Secret Side Deal

How Realtors and Clients Can Use This Knowledge

What an Estoppel Certificate Is

An estoppel certificate is a written statement—usually signed by a tenant—confirming the key facts of their lease agreement. It’s a way for the tenant to “certify” that the lease is valid, current, and in good standing.

In everyday language, it’s the tenant’s way of saying to the lender:

“Yes, we really do have a lease. Here are the details, and there are no surprises.”

The term “estoppel” comes from a legal principle that prevents someone from later contradicting what they’ve already confirmed in writing. So, once a tenant signs that estoppel, they’re legally bound by what it says.

For lenders and buyers, it’s one of the most important verification tools in commercial real estate.

Why Lenders Require It

When a lender finances a commercial property, they’re not just lending against the bricks and mortar—they’re lending against the income stream generated by the tenants.

If the property’s rent roll says Tenant A pays $10,000 a month and Tenant B pays $7,500, the lender wants proof that those leases are real, enforceable, and current.

That’s where estoppel certificates come in. They provide the lender with assurance that:

- The tenants are indeed occupying the premises.

- The lease terms match what’s in the rent roll.

- There are no outstanding disputes, unpaid rent, or side agreements.

Without that confirmation, the lender can’t accurately assess the property’s risk or value. It’s like trying to appraise a restaurant without knowing if it has paying customers.

What’s Included in an Estoppel Certificate

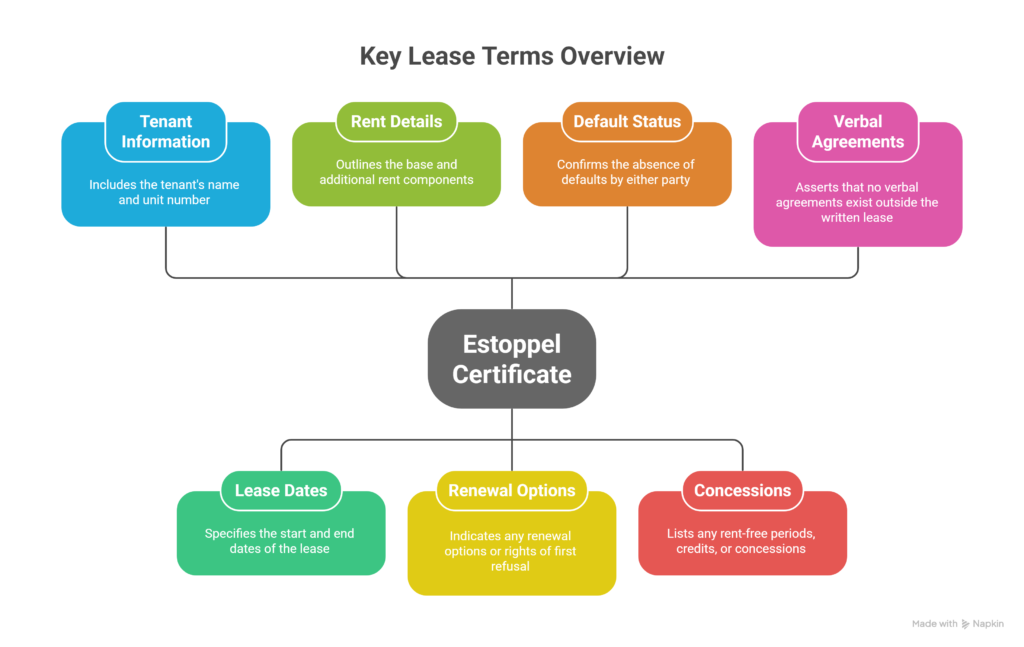

While the exact format can vary, most estoppel certificates include the following details:

- The tenant’s name and suite or unit number.

- The lease start and end dates.

- The base rent and any additional rent (like maintenance or property taxes).

- Whether the tenant has any renewal options or rights of first refusal.

- Confirmation that no defaults exist by either party.

- Any rent-free periods, credits, or concessions currently in effect.

- A statement that no verbal agreements exist outside of the written lease.

In short, it’s a fact-checking document. It ensures that what’s on paper in the lease is exactly what’s happening in real life.

How It Protects Buyers, Borrowers, and Lenders

An estoppel certificate isn’t just for lenders—it protects everyone involved in the transaction.

For lenders, it ensures the income used to underwrite the loan is legitimate and stable.

For buyers, it prevents unpleasant surprises after closing—like discovering that a tenant’s lease is month-to-month instead of five years, or that they were promised a rent reduction that never made it into the contract.

For sellers or borrowers, it smooths the financing process by showing that tenants are cooperative, and the property’s cash flow is reliable.

In short, it’s about certainty—something every party wants when millions of dollars are on the line.

A Real-World Story: The Case of the Secret Side Deal

A few years back, I worked on a refinance for a small retail plaza. The borrower thought everything was straightforward: three tenants, all paying rent on time, leases in place.

But when the lender requested estoppel certificates, one tenant came back with a surprise—they had a handshake agreement with the landlord for reduced rent during winter months. It had never been put in writing.

That “small” detail meant the property’s actual annual income was several thousand dollars lower than what the financials showed.

The lender had to adjust the appraised value and the loan amount. It delayed the deal by weeks and cost the owner a chunk of the financing they’d expected.

If those estoppels hadn’t been requested, the discrepancy might not have come to light until much later—possibly during an audit or a sale.

The moral of the story? Estoppel certificates aren’t red tape—they’re risk management in disguise.

How Realtors and Clients Can Use This Knowledge

If you’re a realtor, understanding estoppel certificates can make you a hero to your clients. You can:

- Encourage sellers to gather tenant estoppels early to avoid last-minute delays.

- Advise buyers that estoppels are non-negotiable when purchasing income-producing property.

- Help identify lease irregularities before the lender or appraiser does.

If you’re a borrower or investor, you can:

- Keep tenant communication clear and professional—cooperative tenants mean smoother deals.

- Review your leases regularly to ensure they reflect the actual terms in practice.

- Use estoppels proactively when preparing a refinancing package—it shows lenders you run a tight ship.

A good rule of thumb? If the cash flow depends on tenants, estoppels are your best friend.

Allen’s Final Thoughts

In the world of commercial mortgages, an estoppel certificate is truth in writing. It’s how lenders, buyers, and investors cut through the noise and confirm exactly what they’re getting.

It’s not just a formality—it’s a foundation. It ensures the income that supports a property’s value is solid, transparent, and verifiable.

As your mortgage agent, my job is to guide you through these nuances—to help you anticipate what lenders will ask for, prepare the documentation ahead of time, and keep your deal running smoothly from start to finish.

Whether you’re buying, refinancing, or developing commercial real estate, I’m here to make sure every box is ticked, every tenant is verified, and every lender walks away confident.

Because in commercial lending, success isn’t just about getting the financing—it’s about proving your numbers. And that’s exactly what estoppel certificates do.