When purchasing a condo, buyers often focus on factors like location, amenities, and square footage. However, one of the most critical aspects that can impact both the value and financial health of a condo is the reserve fund. A condo reserve fund is a crucial financial safety net designed to cover major repairs, replacements, and unexpected expenses for the building.

Unfortunately, many condo buyers overlook the importance of the reserve fund until it’s too late. An insufficient reserve fund can lead to special assessments, deferred maintenance, and even difficulties with mortgage financing. For realtors, financial professionals, and potential condo buyers, understanding reserve funds and identifying warning signs of insufficiency is key to making informed decisions.

Warning Signs That a Condo Reserve Fund May Be Insufficient

Examples of Insufficient Reserve Funds

Impact of Insufficient Reserve Fund

Buying or Owning a Condo with an Insufficient Reserve Fund

Discover and Avoid Condos with Insufficient Reserve Funds

What Is a Condo Reserve Fund?

A condo reserve fund is a mandatory savings account maintained by the condo corporation to cover the cost of major repairs and replacements of common elements, such as the roof, elevators, HVAC systems, and parking facilities. It’s legally required in every province and serves as a financial cushion to ensure that significant building expenses don’t lead to sudden financial stress on owners.

The reserve fund is separate from the operating fund, which covers day-to-day expenses like utilities, maintenance, and janitorial services. Reserve funds focus on long-term capital expenses that could be costly and unpredictable.

Warning Signs That a Condo Reserve Fund May Be Insufficient

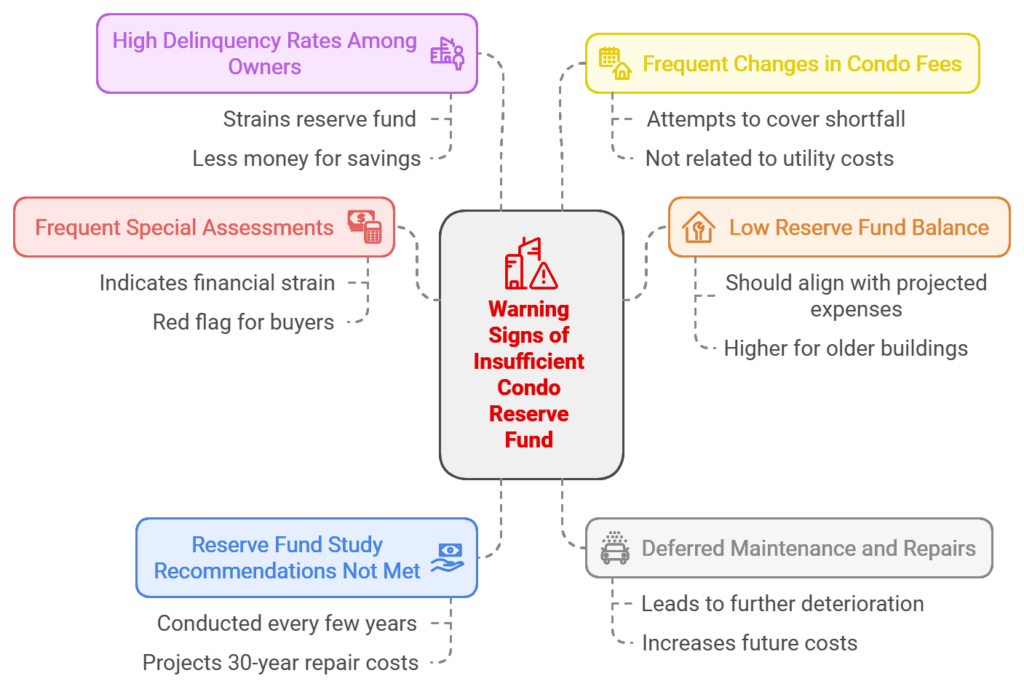

Identifying potential issues with a condo’s reserve fund before purchasing can help avoid financial headaches. Here are the warning signs:

Frequent Special Assessments

One of the most obvious signs of an insufficient reserve fund is the frequency of special assessments—one-time fees charged to owners to cover unexpected expenses. If a condo corporation regularly imposes special assessments, it’s a red flag that the reserve fund may not have enough to cover necessary repairs.

Low Reserve Fund Balance

The balance of the reserve fund is a critical indicator of its adequacy. As a rule of thumb, a healthy reserve fund should have a balance that aligns with the projected expenses outlined in the reserve fund study (more on this below).

For newer buildings, the fund balance might be lower as the building is still new, but for older buildings, the fund should be significantly higher to account for the increased likelihood of major repairs.

Reserve Fund Study Recommendations Not Met

Every condo corporation must conduct a reserve fund study every few years (e.g., every 3 years in Ontario). This study assesses the building’s current condition and projects repair costs over a 30-year period, recommending how much should be saved.

If the reserve fund does not align with the study’s recommendations, it’s a clear sign of insufficiency.

Deferred Maintenance and Repairs

When significant repairs are consistently delayed or deferred due to lack of funds, it’s likely the reserve fund is inadequate. This can lead to further deterioration of the building’s condition, ultimately increasing future repair costs.

High Delinquency Rates Among Owners

If a large percentage of owners are behind on their maintenance fees, it can strain the reserve fund, as less money is available for savings.

Frequent Changes in Condo Fees

Frequent or sharp increases in condo fees may indicate that the condo corporation is trying to make up for a shortfall in the reserve fund, especially when such changes are not related to rising utility or service costs.

Read More: Avoid Blacklisted Condos

Examples of Insufficient Reserve Funds

In a well-known Toronto condo, owners faced an unexpected $20,000 special assessment after a major plumbing issue revealed that the reserve fund was insufficient to cover repairs. The lack of an adequately funded reserve fund not only placed a financial burden on owners but also led to a decrease in property values as potential buyers became wary.

In Vancouver, an older condo building delayed roof replacement for years due to insufficient reserves. The delay led to water damage in several units, costing the condo corporation even more than the original roof repair would have. This situation resulted in frustrated owners and a tarnished reputation for the building.

Impact of Insufficient Reserve Fund

From a mortgage perspective, an insufficient reserve fund can have serious implications:

- Difficulty Securing Mortgage Approvals

- Lower Property Values

- Increased Financial Burden on Owners

- Insurance and Liability Issues

Difficulty Securing Mortgage Approvals

Lenders often review the status certificate, which includes details about the reserve fund, before approving a mortgage. If the reserve fund is deemed insufficient, lenders may consider the building high-risk, resulting in denied applications or more stringent lending terms.

Some lenders may require higher down payments, increased interest rates, or additional documentation to approve a mortgage on a condo with a weak reserve fund.

Lower Property Values

An underfunded reserve fund can deter potential buyers, reducing demand and ultimately affecting the market value of units in the building. Lower demand can make it harder for owners to sell their units quickly or at desired prices.

Increased Financial Burden on Owners

Owners may face sudden special assessments, which can strain their personal finances. This increased financial burden could lead to higher default rates, impacting the financial health of the entire building.

Insurance and Liability Issues

An inadequate reserve fund can lead to deferred maintenance, increasing the risk of accidents or damages within the building. This could result in higher insurance premiums or even difficulty obtaining coverage, further complicating mortgage approvals.

Buying or Owning a Condo with an Insufficient Reserve Fund

If you’re considering buying or currently own a condo with an insufficient reserve fund, there are specific strategies to minimize financial risk:

- Review the Status Certificate Carefully

- Consult with a Professional Mortgage Agent

- Consider Alternative Financing Options

- Negotiate the Purchase Prive

- Advocate for Better Reserve Fund Management

Review the Status Certificate Carefully

The status certificate contains detailed information about the reserve fund, current financial statements, and any pending special assessments. Work with a real estate lawyer to understand the details and identify potential risks.

Consult with a Professional Mortgage Agent

Mortgage agents with experience in condos can provide insights into the building’s financial health, potential risks, and the likelihood of securing mortgage financing.

Consider Alternative Financing Options

If traditional lenders view the building as high-risk, explore B lenders or private lenders. These lenders may be more flexible, though they often come with higher interest rates and fees.

Negotiate the Purchase Price

Use the insufficiency of the reserve fund as leverage to negotiate a lower purchase price, accounting for potential future costs or special assessments.

Advocate for Better Reserve Fund Management

If you already own a unit, engage with the condo board to push for improved financial management and compliance with reserve fund study recommendations. Transparency and proactive planning can help improve the building’s financial health over time.

Read More

- Appraisal Nightmare

- Condominium Conditions

- Understanding Condo Reserve Funds

- Avoid Blacklisted Condos

- Lenders Don’t Like Condotels

- Do You Need Title Insurance for a Condo?

- Understanding Condominium Fees

Discover and Avoid Condos with Insufficient Reserve Funds

Ensure you do the following to discover and avoid condos with insufficient reserve funds:

- Prioritize the Status Certificate Review

- Work with Experienced Professionals

- Ask the Right Questions

- Consider Newer Buildings with Caution

Prioritize the Status Certificate Review

Make reviewing the status certificate a mandatory part of your due diligence before buying a condo. Pay special attention to the reserve fund study, current reserve fund balance, and any pending assessments.

Work with Experienced Professionals

Engage realtors, mortgage agents, and legal experts who understand the complexities of condo purchases and can guide you through the financial implications of an insufficient reserve fund.

Ask the Right Questions

When viewing a condo, ask specific questions about the reserve fund, upcoming repairs, recent special assessments, and how the condo board plans to handle future expenses.

Consider Newer Buildings with Caution

While newer condos often have lower reserve fund balances due to fewer repairs, it’s essential to ensure that the condo corporation is contributing adequately to build up reserves over time.

Summary

Whether you’re a realtor, financial professional, or potential condo buyer, understanding the role and health of a condo’s reserve fund is crucial to making informed real estate decisions. An insufficient reserve fund can lead to financial headaches, unexpected costs, and even difficulties in securing a mortgage. By being aware of the warning signs, impacts, and strategies for managing these risks, you’ll be better equipped to navigate the condo market confidently.